Additional High Performance Program:

Programmatic Guidance Document

- Guidance Document is also available in Portable Document Format (PDF)

Last Edited: October 7, 2016

ADDITIONAL HIGH PERFORMANCE PROGRAM (AHPP) PROGRAMMATIC GUIDANCE DOCUMENT

| CONTENTS | |

|---|---|

| A. | PROGRAM PURPOSE |

| B. | PROGRAM TIMELINE |

| C. | ROLES AND RESPONSIBILITIES

a. DOH Responsibilities b. MCO Responsibilities c. PPS Responsibilities |

| D. | MCO–PPS PAIRINGS |

| E. | PROGRAM MEASURES |

| F. | PAYMENT MECHANISM

a. Payments from DOH to MCO b. Payments from MCO to PPS |

| G. | PAYMENT CONDITIONS |

| H. | PAYMENT TRACKING

a. Flow of Funds b. Recourse for Failure to Comply |

| I. | QUESTIONS FROM MCOs AND PPS |

The purpose of this document is to provide a high level explanation of the design and function of the Additional High Performance Program (AHPP).

A. PROGRAM PURPOSE

AHPP was created to further incentivize Performing Provider Systems (PPS) participating in the Delivery System Reform Incentive Payment (DSRIP) Program to maximize their achievement of selected key measures as part of the federally funded DSRIP High Performance Fund (HPF).

Through State–invested funds, AHPP incentivizes DSRIP Program participants to achieve high performance for by focusing in on HPF measures that all PPS are undertaking.

|top of page|B. PROGRAM TIMELINE

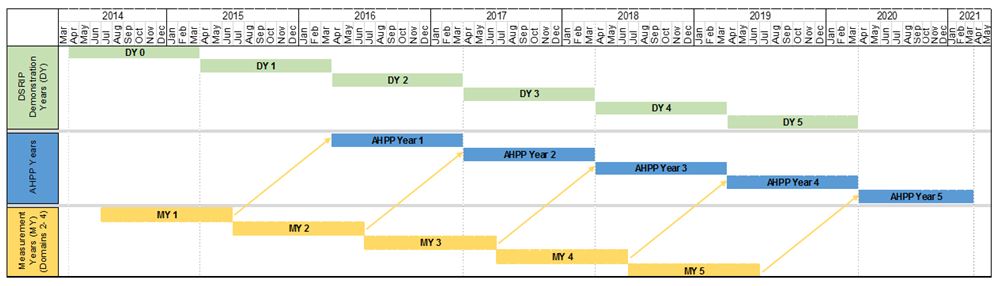

AHPP is a five–year program, starting on April 1, 2016 and ending on March 31, 2021. AHPP awards are determined based on the achievement of specific DSRIP measures (that have been chosen for AHPP) in the prior year. Hence, AHPP Year (AY) 1 (April 2016–March 2017) payments are based upon DSRIP Demonstration Year (DY) 1 (April 2015–March 2016) performance during Measurement Year (MY) 1 (July 2014–June 2015). In other words, AHPP lags the DSRIP program by one year. Please see Section E for additional information on program measures.

The relationship between DSRIP DYs, AHPP Program Years, and DSRIP MYs is illustrated below:

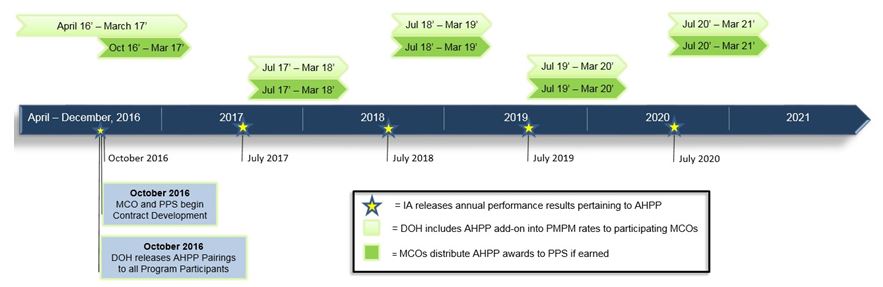

The AHPP timeline with milestones and due dates is detailed below.

| Milestone | Due Date |

|---|---|

| DOH releases AHPP Pairings to program participants | October 2016 |

| Paired Managed Care Organizations (MCOs) and PPS develop AHPP contracts | October 2016 – December 31, 2016 |

| Independent Assessor (IA) releases annual performance results pertaining to AHPP | AY 1 results released: October 2016 AY 2 results released: July 2017 AY 3 results released: July 2018 AY 4 results released: July 2019 AY 5 results released: July 2020 |

| DOH includes AHPP add–on into per member per month (PMPM) rates to participating MCOs:

• Year 1: Funds added in April 2016 rates • Years 2–5: Funds added in July rates annually Due to CMS delays in rate approval process, funds flow process at the beginning of each year may be delayed. Once approved, payments will be retroactive to AHPP Year start date. • Full award amounts will be paid out over 12 months in AHPP Year 1 and over 9 months in AHPP Years 2–5 |

AY 1 payments time period: April 2016 – March 2017 (12 months) AY 2 payments time period: July 2017 – March 2018 (9 months) AY 3 payments time period: July 2018 – March 2019 (9 months) AY 4 payments time period: July 2019 – March 2020 (9 months) AY 5 payments time period: July 2020 – March 2021 (9 months) |

The payment timeline below illustrates the timeline for the IA to release AHPP performance results, DOH to include AHPP amounts into PMPM rates, and MCOs to distribute earned AHPP awards to PPS.

C. ROLES AND RESPONSIBILITIES

- DOH Responsibilities

- Provide MCOs with criteria for funds distribution.

- Monitor and oversee the distribution funds from the MCOs to PPS.

- Fund the program through an increase in the PMPM to participating MCOs, inclusive of an administrative fee.

- Provide contractual and programmatic guidance when requested by the MCOs.

- MCO Responsibilities

- Contract with PPS for AHPP

- Distribute earned AHPP awards to high performing PPS as defined by the program and determined by the IA based on PPS achievement of AHPP measures.

- Report to DOH on the flow of AHPP funds from MCOs to PPS.

- PPS Responsibilities

- Contract with MCOs for AHPP.

- Work towards the achievement of AHPP measures.

D. MCO–PPS PAIRINGS

All PPS participating in the DSRIP Program are eligible to participate in AHPP. The below table displays annual AHPP award amounts available to each PPS that achieve its AHPP targets. The current pairing table displays the 25 PPS paired with the four MCOs participants: Amerigroup, Fidelis, Healthfirst and United.

The amounts listed below are the minimum AHPP awards each PPS will earn if all 25 PPS meet the AHPP performance requirements for the year. These amounts were calculated based on the distribution of attributed lives for each of the PPS participating in DSRIP. Within a given year, unearned AHPP awards will be redistributed and disbursed to PPS that met the AHPP performance requirements in a weighted manner based upon the distribution of DSRIP lives associated with the PPS.

| AHPP Annual Award | |||||

|---|---|---|---|---|---|

| Performing Provider System | NYS Catholic Health Plan Inc. | Healthfirst PHSP Inc. | United Healthcare of NY Inc. | Amerigroup New York LLC | |

| Adirondack Health Institute | $ 767,436 | $ – | $ – | $ – | $ 767,436 |

| Advocate Community Providers | $ – | $ 6,103,489 | $ – | $ – | $ 6,103,489 |

| Albany Medical Center Hospital | $ 661,373 | $ – | $ – | $ – | $ 661,373 |

| Alliance for Better Health Care (Ellis) | $ 1,168,653 | $ – | $ – | $ – | $ 1,168,653 |

| Bronx–Lebanon Hospital Center | $ – | $ 1,346,085 | $ – | $ – | $ 1,346,085 |

| Central New York Care Collaborative | $ 1,767,346 | $ – | $ – | $ – | $ 1,767,346 |

| Finger Lakes PPS | $ 2,801,440 | $ – | $ – | $ – | $ 2,801,440 |

| Lutheran Medical Center | $ – | $ 1,099,822 | $ – | $ – | $ 1,099,822 |

| Maimonides Medical Center | $ – | $ – | $ 4,299,479 | $ – | $ 4,299,479 |

| Millennium Collaborative Care (ECMC) | $ 2,391,904 | $ – | $ – | $ – | $ 2,391,904 |

| Mohawk Valley PPS (Bassett) | $ – | $ – | $ 394,800 | $ – | $ 394,800 |

| Montefiore Hudson Valley Collaborative | $ 2,167,361 | $ – | $ – | $ – | $ 2,167,361 |

| Mount Sinai Hospitals Group | $ – | $ 3,498,247 | $ – | $ – | $ 3,498,247 |

| Nassau Queens PPS | $ – | $ – | $ – | $ 3,948,024 | $ 3,948,024 |

| New York City Health Hospitals Corporation | $ – | $ 6,412,413 | $ – | $ – | $ 6,412,413 |

| Refuah Community Health Collaborative | $ 399,192 | $ – | $ – | $ – | $ 399,192 |

| Samaritan Medical Center | $ – | $ – | $ 376,478 | $ – | $ 376,478 |

| SBH Health System (St. Barnabas) | $ – | $ 3,382,663 | $ – | $ – | $ 3,382,663 |

| Sisters of Charity Hospital of Buffalo (Catholic Medical) | $ 807,072 | $ – | $ – | $ – | $ 807,072 |

| Southern Tier Rural Integrated PPS (United Health) | $ 968,840 | $ – | $ – | $ – | $ 968,840 |

| Staten Island PPS | $ – | $ – | $ – | $ 721,545 | $ 721,545 |

| Stony Brook University Hospital | $ 2,009,085 | $ – | $ – | $ – | $ 2,009,085 |

| The New York and Presbyterian Hospital | $ – | $ – | $ 849,366 | $ – | $ 849,366 |

| The New York Hospital Medical Center of Queens | $ – | $ – | $ – | $ 284,535 | $ 284,535 |

| Westchester Medical Center | $ 1,373,350 | $ – | $ – | $ – | $ 1,373,350 |

| Total | $ 17,283,054 | $ 21,842,718 | $ 5,920,124 | $ 4,954,104 | $ 50,000,000 |

The highlighted PPS are participating in the Equity Programs (EP). These PPS are eligible to be awarded Equity Program funding that flows to AHPP if it is unearned in a given year of EP. See Section G, Payment Conditions, for more detail.

|top of page|E. PROGRAM MEASURES

AHPP measures are a subset of the twelve measures that make up the federally funded DSRIP HPF. Nine of the 12 HPF measures that were applicable to all 25 PPS were chosen as AHPP measures.

The following table denotes the 12 HPF measures and identifies the 9 AHPP measures.

| Projects | Measure Name | P4P* Timing |

DSRIP AV | |

|---|---|---|---|---|

| AHPP and HPF Measures | 2.a.i–2.a.v | Potentially Preventable Emergency Department Visits (PPV) (All Population) | DY3 | 1 |

| 2.a.i–2.a.v | Potentially Preventable Readmissions (PPR) (All Population) | DY3 | 1 | |

| 3.a.i–3.a.iv | Antidepressant Medication Management – Effective Acute Phase Treatment | DY2 | 0.5 | |

| 3.a.i–3.a.iv | Antidepressant Medication Management – Effective Continuation Phase Treatment | DY2 | 0.5 | |

| 3.a.i–3.a.iv | Cardiovascular Monitoring for People with Cardiovascular Disease (CVD) and Schizophrenia | DY2 | 1 | |

| 3.a.i–3.a.iv | Diabetes Monitoring for People with Diabetes and Schizophrenia | DY2 | 1 | |

| 3.a.i–3.a.iv | Follow–up after hospitalization for Mental Illness – within 30 days | DY2 | 0.5 | |

| 3.a.i–3.a.iv | Follow–up after hospitalization for Mental Illness – within 7 days | DY2 | 0.5 | |

| 3.a.i–3.a.iv | Potentially Preventable Emergency Department Visits (Behavioral Health (BH) Population) | DY2 | 1 | |

| HPF Measures Only | 3.a.v | Antipsychotic Use in Persons with Dementia (SNF Long Stay Residents) | DY2 | 1 |

| 3.b.i–3.b.ii | Tobacco Cessation – Discussion of Cessation Strategies | DY4 | 1 | |

| 3.b.i–3.b.ii | Controlling Hypertension | DY4 | 1 |

*P4P – Pay for Performance

| Indicates measures are combined in the traditional DSRIP High Performance Fund, meaning the measures is worth 0.5 AV. |

Each of the nine AHPP measures will be evaluated as either achieved or not achieved. The nine AHPP measures are weighted evenly and all measures count every year regardless of whether or not the measure is Pay for Reporting (P4R) or P4P, so long as the IA determines that the PPS qualifies for the measure. If a PPS meets performance goals for at least 50% of the qualifying measures for a given year, the PPS will have met the performance requirements to earn AHPP payment for that performance period.

The IA will determine that a PPS does not qualify for an AHPP measure in a given measurement year if the denominator of an AHPP measure for a PPS falls below 30 in a given year. In this case, the achievement value associated with the measure is removed from the base AHPP calculation for the next two years (hence if a PPS is disqualified from one measure, then achievement of 4 out of 8 AHPP measures (50%) will be needed to qualify for an AHPP award in that year).

There are no partial earnings for AHPP: a PPS achieving less than 50% of the qualifying AHPP measures will not receive an AHPP award payment that year. PPS that achieve more than 50% of the qualifying AHPP measures will receive their specified award amount, plus any redistributed AHPP dollars resulting from other PPS not meeting the performance threshold in that year. There is no additional award given to PPS that achieve, for example, 100% of the measures over their award for achieving 50% of the measures – so long as a PPS meets the 50% threshold, it receives its specified award amount plus any redistributed dollars. PPS will be evaluated annually for AHPP, using the fourth quarter (Q4) IA analysis results to determine achievement of measures.

Assuming no disqualifications due to low denominators, all PPS are evaluated on all of the following nine AHPP measures:

| Projects | Measure Name | Pay For Performance (P4P) Timing |

|---|---|---|

| 2.a.i–2.a.v | Potentially Preventable Emergency Department Visits (PPV) (All Population) | DY3 |

| 2.a.i–2.a.v | Potentially Preventable Readmissions (PPR) (All Population) | DY3 |

| 3.a.i–3.a.iv | Antidepressant Medication Management – Effective Acute Phase Treatment | DY2 |

| 3.a.i–3.a.iv | Antidepressant Medication Management – Effective Continuation Phase Treatment | DY2 |

| 3.a.i–3.a.iv | Cardiovascular Monitoring for People with Cardiovascular Disease (CVD) and Schizophrenia | DY2 |

| 3.a.i–3.a.iv | Diabetes Monitoring for People with Diabetes and Schizophrenia | DY2 |

| 3.a.i–3.a.iv | Follow–up after hospitalization for Mental Illness – within 30 days | DY2 |

| 3.a.i–3.a.iv | Follow–up after hospitalization for Mental Illness – within 7 days | DY2 |

| 3.a.i–3.a.iv | Potentially Preventable Emergency Department Visits (Behavioral Health (BH) Population) | DY2 |

F. PAYMENT MECHANISM

- Payments from DOH to MCO

- DOH will effectuate payments to the MCOs on a monthly basis through the PMPM rates starting in April 2016 for AHPP Year 1, and starting in July 2017 for AHPP Years 2–5. There will therefore be 12 monthly payments in Year 1, and 9 monthly payments in the later years of the program.

- In the case that the PMPM rate development is delayed, payments will begin as soon as they are available. In this case the first payment made will be retroactive to the start of the period (April for Year 1, July for Years 2 – 5), resulting in the MCOs receiving the full allocated amount over the course of each AHPP Year.

- DOH retains the right to make rate adjustments as necessary throughout the program, between program years.

- Payments from MCO to PPS

- MCOs are responsible for distributing earned AHPP funds provided by DOH to the PPS.

- AHPP payments are never made prospectively, but instead are made after a PPS´ AHPP measure achievement is known for a given year.

- Payments are expected to flow from the MCOs to the PPS on a monthly basis, once annual performance has been determined by the IA.

G. PAYMENT CONDITIONS

- Unlike the HPF, there is no payment cap on what a PPS can be awarded through the AHPP.

- A PPS will receive its annual AHPP award if it meets its performance requirement for at least 50% of its qualifying AHPP measures for that year. This means that each year, a PPS must achieve at least 50% of its measures to receive its AHPP payment.

- If in a given year a denominator for an AHPP measure falls below 30, the PPS will not qualify for that AHPP measure and the measure will be removed from the PPS´ AHPP performance threshold calculation. The PPS will instead have to achieve the performance threshold for at least 50% of the remaining AHPP measures. For example, a PPS with one denominator below 30 will need to achieve performance in 4 of the 8 remaining measures.

- Once a PPS is disqualified from a measure, the measure must have a denominator above 30 for two years for the PPS to once more be qualified for it for the purpose of AHPP performance measurement. This is due to the fact that the first year with a sufficient denominator will serve as a baseline to measure future year improvement, while only the second year will provide sufficient information for the PPS to be evaluated on the measure.

- The IA will determine whether each PPS achieves each of the AHPP measures annually. If a measure meets either of the two requirements below, it is considered achieved for the year. PPS do not have to meet both requirements:

- If the PPS meets or exceeds a reduction in gap to goal for a measure by 10% or more within the annual measurement period , the measure is considered achieved; or,

- If the PPS´s performance in the metric reaches and stays within the statewide performance goal for the year, the measure is considered achieved.

- The IA will evaluate AHPP measure performance based on the PPS´ entire attributed population, and not just the attributed population between the PPS and its paired MCO.

- If less than half of all PPS are able to meet the 50% measure achievement threshold, the state reserves the right to readjust the achievement threshold to allow at least half of the PPS to qualify for their AHPP awards that year.

- Unclaimed AHPP funds derived from unearned AHPP payments from that year will be disbursed proportionally based on the relative weighting of lives within AHPP for those PPS that qualify for their AHPP awards in that year.

- The full allocation of the original AHPP allotments will be paid out each year. No AHPP funds will be carried over into later years of the program.

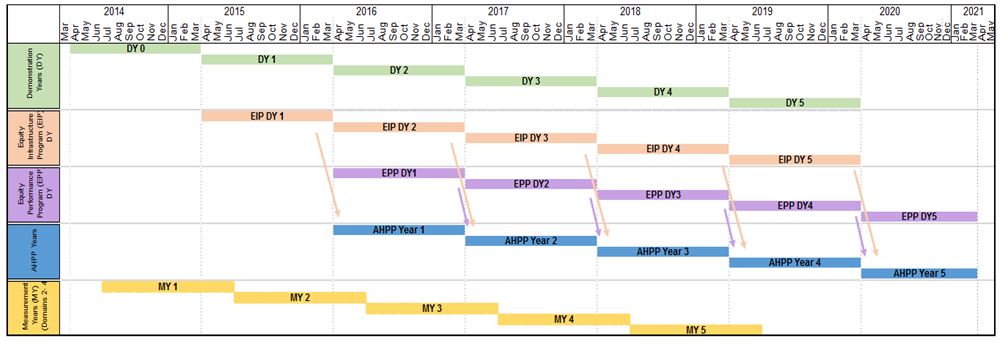

- EP Participants

- Unearned EP funds will flow into the AHPP pool for the following year. These additional funds will only be earnable through AHPP by PPS that are participating in the EP (see highlighted PPS in Section D, MCO–PPS Pairings).

- The different timelines between EIP, EPP, and AHPP affect the timing of the flow of unearned EP funds into AHPP. Unearned EIP DY1 funds flow into AHPP Year 1, while unearned EPP DY1 funds and EIP DY2 funds flow in AHPP Year 2.

- While unearned EIP DY5 funds will flow into AHPP Year 5, unearned EPP DY5 funds will not roll over into AHPP the following year and will be lost.

- See the timeline below for more detail:

- AHPP funds derived from prior–year unearned EP payments will be distributed to PPS meeting AHPP requirements based on their relative award weightings within EP.

- Unearned EP funds will flow into the AHPP pool for the following year. These additional funds will only be earnable through AHPP by PPS that are participating in the EP (see highlighted PPS in Section D, MCO–PPS Pairings).

H. PAYMENT TRACKING

- Flow of Funds

- DOH will set PMPM rates for AHPP in April for the first year of the program, and in July for the remaining years.

- DOH will track the flow of funds to help ensure that participants have complied with the program. It is the responsibility of the MCOs as part of their administrative duties to ensure that the flow of funds is accurate and properly documented.

- Payments will be recorded and submitted to DOH in the Medicaid Managed Care Operating Reports (MMCOR).

- DOH and other governing authorities reserve the right to audit all payments, reports, and actions.

- Recourse for Failure to Comply

- DOH may recoup payments or remove participants from the program as it sees fit in cases where there is failure to comply with the program activities and reporting requirements.

- MCOs and PPS can be removed from the program at the discretion of DOH.

I. QUESTIONS FROM MCOs AND PPS

The participating parties may submit questions to the State Supplemental Program inbox at:

dsrip_ssp@health.ny.gov

Please include ´AHPP´ in the subject name.

|top of page|

Follow Us