High Performance Fund Standard Operating Procedure (SOP)

- SOP is also available in Portable Document Format (PDF)

September 2015 dsrip@health.ny.gov

The purpose of this Standard Operating Procedure is to describe the protocols for earning and distributing the DSRIP high performance funding (HPF). This document provides a background of the HPF policy, measures, and methodology as defined by the Department of Health (DOH). Additionally, the methodology for calculating high performance payments is illustrated at a high level. Please note that it is recommended that this document be reviewed in tandem with the accompanying Excel workbook to assist in understanding HPF calculations.

HIGH PERFORMANCE FUND BACKGROUND

Attachment I, Sections III.b, III.c, VIII.c, IX.c, Attachment J, Section II, and the DSRIP Measure Specification and Reporting Manual, Section II discuss the DSRIP HPF. A PPS may be eligible for HPF payments in addition to regular DSRIP performance payments. In each DSRIP Project Plan Award Letter, each PPS was notified of their Net HPF (3%) amount. This amount is referred to as the DSRIP high–performance waiver funding. PPS are not limited to the high performance funding amounts indicated in their award letters and may earn high performance fund payments up to 30% of their DSRIP project value. HPF is awarded to PPS that exceed high performance targets (20% gap to goal performance) for high performance quality metrics or achieve high performance by exceeding state performance targets.

OTHER HIGH PERFORMANCE FUNDING SOURCES

This document describes the protocols for earning and distributing of the DSRIP HPF only and does not describe protocols for other high performance funding sources, such as the state equity performance funding and state additional high performance funding that has been communicated to PPS and is funded by state, non–waiver dollars. The payment methodology for these additional sources of funding is currently being approved by DOH.

HIGH PERFORMANCE FUND – ELIGIBLE MEASURES

The measures eligible for high–performance payments are delineated in Attachment J, Section II of the STC document. Ten measures, found in subdomains 2.a., 3.a. and 3.b., are eligible for HPF payments:

- Potentially Preventable Emergency Department Visits (All Population)

- Potentially Preventable Readmissions (All Population)

- Potentially Preventable Emergency Department Visits (BH Population)

- Potentially Preventable Readmissions (BH Population in SNF)

- Follow–up for Hospitalization for Mental Illness

- Antidepressant Medication Management

- Diabetes Monitoring for People with Diabetes and Schizophrenia

- Cardiovascular Monitoring for People with CVD and Schizophrenia

- Controlling Hypertension

- Tobacco Cessation – Discussion of Cessation Strategies (Note: This measure refers only to the component measure discussing smoking and tobacco use cessation strategies, not the component measures on advising to quit or discussing cessation medication.)

Two of the ten measures are composite measures, composed of two component measures, each worth 0.5 Achievement Values (AVs): "Follow–up for Hospitalization for Mental Illness" and "Antidepressant Medication Management". The component measures are treated as separate measures and each assigned half the PPS attribution amount in the HPF allocation process.

The two HPF composite measures are below are shown in Figure 1.

Figure 1

| Composite Measure Name |

|---|

| Follow–up after hospitalization for Mental Illness – within 30 days |

| Follow–up after hospitalization for Mental Illness – within 7 days |

| Antidepressant Medication Management – Effective Acute Phase Treatment |

| Antidepressant Medication Management – Effective Continuation Phase Treatment |

The HPF measures are applicable to multiple projects within subdomains 2.a., 3.a. and 3.b.

(Note: Domain 4 has no high performance.)

Only Pay–For–Performance (P4P) measures are eligible for high performance funding. Most HPF measures are P4P starting in Demonstration Year (DY) 2, the first year of HPF eligibility, with the exception of four measures indicated in Figure 2 below that transition from Pay–For–Reporting (P4R) measures to P4P in later DSRIP Program Demonstration years. Since PPS may only earn high performance funding for P4P measures, these measures will become eligible for HPF payments when they transition to P4P.

Figure 2 provides a breakdown of HPF eligible measures and their associated DSRIP projects.

Figure 2

| Project | Performance Measure Name | DY Measure Becomes P4P |

|---|---|---|

| 2.a.i–2.a.v | Potentially Preventable Emergency Department Visits (All Population) | DY3 |

| 2.a.i–2.a.v | Potentially Preventable Readmissions (All Population) | DY3 |

| 3.a.i–3.a.iv | Antidepressant Medication Management | DY2 |

| 3.a.i–3.a.iv | Cardiovascular Monitoring for People with CVD and Schizophrenia | DY2 |

| 3.a.i–3.a.iv | Diabetes Monitoring for People with Diabetes and Schizophrenia | DY2 |

| 3.a.i–3.a.iv | Follow–up for Hospitalization for Mental Illness | DY2 |

| 3.a.i–3.a.iv | Potentially Preventable Emergency Department Visits (BH Population) | DY2 |

| 3.a.v | Potentially Preventable Readmissions (BH Population in SNF) | DY2 |

| 3.b.i–3.b.ii | Tobacco Cessation – Discussion of Cessation Strategies | DY4 |

| 3.b.i–3.b.ii | Controlling Hypertension | DY4 |

HIGH PERFORMANCE FUND METHODOLOGY

PPS who have achieved high performance (exceeding 20% gap to goal targets for Tier 1 or exceeding state performance targets) will be eligible for additional payment from the DSRIP HPF, not to exceed 30% of their DSRIP project valuation.

High performance funding amounts are distributed annually coinciding with the second payment period of DYs 2–5. This is different from the payment frequency of regular performance payments, which are paid semi–annually. If more frequent reporting (more than annual) of metric results are required for projects, the reported results for HPF fund payments should be based on a standard twelve–month period.

Regular performance funding not earned due to missed Achievement Values in Domains 1–4 is re–allocated to the HPF. Excess high–performance funding that cannot be distributed due to valuation caps will be distributed to other applicable domains and HPF measures in each annual HPF payment period. High performance funding that is unearned in a Demonstration Year will carry over one–year. These unearned, carried over funds will be distributed in the carry over year prior to any new high–performance dollars being awarded. After the one year carryover period, if the high performance funds are still unearned, they are forfeited. For example, DY2 HPF dollars that are missed due to unearned AVs will carry over to DY3. This carryover amount will be distributed in DY3 prior to any new DY3 HPF being awarded. If this carryover amount is still unearned in DY3, the amount is forfeited from the high–performance pool.

The HPF STC percentage allocations have been aligned with the STC funding distributions, while being adjusted to a four–year period that reflects the timeframe of HPF payments occurring in DY2 – DY5. Figure 3 outlines the HPF STC percentages:

Figure 3

| High Performance Fund STC % | |||||

|---|---|---|---|---|---|

| DY2 | DY3 | DY4 | DY5 | ||

| 20.05% | 32.42% | 28.71% | 18.81% | ||

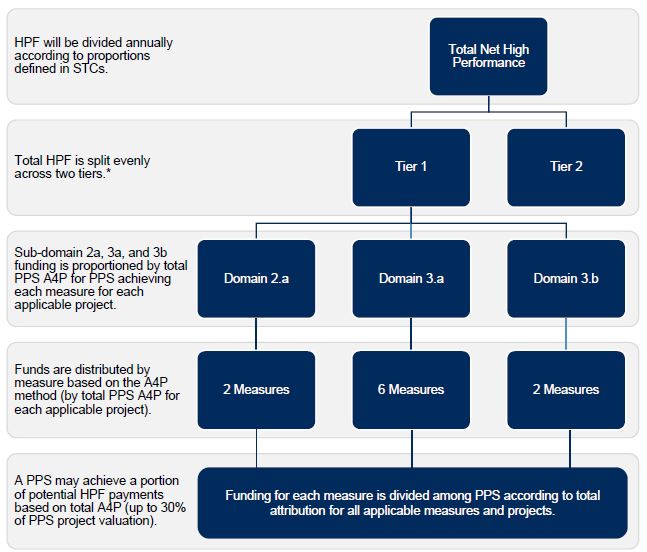

The allocation of funding to subdomains, measures, and PPS is outlined in the 5 steps below:

Step 1: Annual Funding Percentage

For each Demonstration Year, the Total Net High Performance amount is multiplied by the applicable HPF STC percentage to determine the annual HPF amount.

Step 2: Annual HPF Divided into Tiers 1 and 2

Half of the annual HPF will be available for Tier 1 payments and the remaining half will be available for Tier 2 payments. Qualifying for Tier 1 and Tier 2 will be determined as follows:

- Higher performing participating providers whose performance closes the gap between their current performance and the high–performance level by 20% or more for the measurement period shall receive Tier 1 level reward payments.

- Higher performing participating providers whose performance meets or exceeds the statewide performance target for the measurement period shall receive Tier 2 level reward payments.

PPS may earn both Tier 1 and Tier 2 funding in the first period that a PPS exceeds the state performance target (thus closing the gap 100% and qualifying for the Tier 1 20% gap to goal requirement). If a PPS has a HPF measure baseline on or higher than the statewide performance goal at the beginning of the measurement period, and either has no change in performance or stays above the statewide performance goal, the PPS will earn Tier 2 HPF payments.

Note: The proportions for the annual HPF may be adjusted by the state as appropriate to account for volume of demand on the HPF.

Step 3: HPF Divided into Subdomains

Within each tier, distribution of funding within subdomains is intended to reflect the overall number of individuals impacted by DSRIP projects based on attribution of each PPS and number of projects chosen within each subdomain. More specifically, subdomain 2a, 3a, and 3b funding is proportioned based on total PPS Attribution for Performance (A4P) for PPS achieving each HPF measure multiplied by the number of applicable projects chosen by the PPS. To maximize availability of funds that PPSs may earn in a performance period, funding is allocated only to the subdomains in which PPS have earned high performance. For example, if in a given measurement period, PPS only earn high performance for measures applicable to subdomain 3a projects, all annual HPF is allocated to subdomain 3a.

Step 4: HPF Allocated to Measures

Since HPF distribution is based on achievement towards specific measures, funds are further divided among HPF measures (for which high performance was achieved in the current measurement period) based on a similar method utilizing A4P times number of applicable projects chosen by PPS. HPF among measures is distributed based on the percent allocation of total PPS–project A4P (total PPS A4P multiplied by number of projects applicable to each measure). The percent of subdomain funding attributed to each measure is then based on the percentage of A4P associated with each measure based on this method.

Step 5: HPF Allocated to PPS

If only one PPS achieves HPF on a measure, the PPS earns the full dollar amount allocated to the measure in Step 4. However, if multiple PPS achieve high performance for an individual measure, the A4P method used in previous steps is further applied to determine the PPS proportional share of funding within each measure allocation. In this case, the PPS A4P is multiplied by number of applicable projects by measure. The percent of funding earned by each PPS is then based on the PPS percent of the total attribution figure calculated per measure.

HPF allocations that have exceeded the 30% project value threshold for a PPS will be redistributed using the same five steps indicated above until all HPF are distributed or all PPS earning HPF have hit their 30% cap.

Figure 4 provides an overview of the HPF allocation steps.

The accompanying worksheet provides an example of the HPF distribution in a hypothetical performance scenario.

Figure 4

Distribution of Tier 1 HPF to Subdomain, HPF Measure, and PPS Achieving High Performance

* Note: The proportions for the annual HPF may be adjusted by the state as appropriate to account for volume of demand on the HPF.

Follow Us