New York State Medicaid Update - March 2017 Volume 33 - Number 3

In this issue …

- All Providers

- Medicaid Breast Cancer Surgery Centers (cover)

- Electronic Prescribing - New Blanket Waiver for Exceptional Circumstances

- Attention Family Planning Providers: Medicaid-covered Long Acting Reversible Contraceptives

- Update on the Smoking Cessation Benefit in Medicaid Fee-for-Service and Medicaid Managed Care

- 2017 Spousal Impoverishment Income and Resource Levels Increase

- NY Medicaid EHR Incentive Program Update

- Policy and Billing Guidance

- Pharmacy Update

Medicaid Breast Cancer Surgery Centers

Research shows that five-year survival increases for women who have their breast cancer surgery performed at high-volume facilities and by high-volume surgeons. Therefore, it is the policy of New York State Department of Health (the Department) that Medicaid recipients receive mastectomy and lumpectomy procedures associated with a breast cancer diagnosis, at high-volume facilities defined as averaging 30 or more all-payer surgeries annually over a three-year period. Low-volume facilities will not be reimbursed for breast cancer surgeries provided to Medicaid recipients. This policy is part of an ongoing effort to reform New York State (NYS) Medicaid and to ensure the purchase of cost-effective, high-quality health care and better outcomes for its recipients.

The Department has completed its ninth annual review of all-payer breast cancer surgical volumes for 2013 through 2015 using the Statewide Planning and Research Cooperative System (SPARCS) database. Seventy-three low-volume hospitals and ambulatory surgery centers throughout New York State were identified. These facilities have been notified of the restriction effective April 1, 2017. The policy does not restrict a facility's ability to provide diagnostic or excisional biopsies and post-surgical care (chemotherapy, radiation, reconstruction, etc.) for Medicaid patients. Other facilities in the same region as the restricted facilities have met or exceeded the volume threshold and Medicaid patients who require breast cancer surgery should be directed to those providers.

The Department will annually re-examine all-payer SPARCS surgical volumes to revise the list of low-volume hospitals and ambulatory surgery centers. The annual review will also allow previously restricted providers meeting the minimum three-year average all-payer volume threshold to provide breast cancer surgery services for Medicaid recipients.

For more information and the list of restricted low-volume facilities, please see:http://www.health.ny.gov/health_care/medicaid/quality/surgery/cancer/breast/. If you have any questions, please contact the Department at (518) 486–9012 .

Electronic Prescribing - New Blanket Waiver for Exceptional Circumstances

The Commissioner of Health has approved a new blanket waiver with respect to the electronic prescribing requirements of Public Health Law (PHL) § 281 and Education Law § 6810. Effective March 26, 2017, it will replace and supersede the prior blanket waiver, issued by letter dated March 16, 2016, for exceptional circumstances in which electronic prescribing cannot be performed due to limitations in software functionality. The exceptional circumstances for which this waiver applies are set forth below.

The Department recognizes that the standards developed by the National Council for Prescription Drug Programs (NCPDP), as adopted by the Centers for Medicare and Medicaid Services (CMS), have been continuously revised since they were first published in 2005 but still do not address every prescribing scenario. The current standards allow only a limited number of characters in the prescription directions to the patient including, but not limited to, taper doses, insulin sliding scales, and alternating drug doses.

Similarly, for compound drugs, no unique identifier is available for the entire formulation. Typing the entire compound on one text line may lead to prescribing or dispensing errors, potentially compromising patient safety. Further, the Department is mindful that practitioners must issue non-patient specific prescriptions in certain instances, and that such prescriptions cannot be properly entered into the electronic prescription software.

For these reasons, pursuant to the authority in PHL § 281(3), the Commissioner of Health will continue to waive the following exceptional circumstances from the requirements of electronic prescribing:

- any practitioner prescribing a controlled or non-controlled substance, containing two (2) or more products, which is compounded by a pharmacist;

- any practitioner prescribing a controlled or non-controlled substance to be compounded for the direct administration to a patient by parenteral, intravenous, intramuscular, subcutaneous or intraspinal infusion;

- any practitioner prescribing a controlled or non-controlled substance that contains long or complicated directions;

- any practitioner prescribing a controlled or non-controlled substance that requires a prescription to contain certain elements required by the federal Food and Drug Administration (FDA) that are not able to be accomplished with electronic prescribing;

- any practitioner prescribing a controlled or non-controlled substance under approved protocols for expedited partner therapy, collaborative drug management or comprehensive medication management, or in response to a public health emergency that would allow a non-patient specific prescription;

- any practitioner prescribing an opioid antagonist that would allow a non-patient specific prescription;

- any practitioner prescribing a controlled or non-controlled substance under a research protocol;

- a pharmacist dispensing controlled and non-controlled substance compounded prescriptions, prescriptions containing long or complicated directions, and prescriptions containing certain elements required by the FDA or any other governmental agency that are not able to be accomplished with electronic prescribing;

- a pharmacist dispensing prescriptions issued under a research protocol, or under approved protocols for expedited partner therapy, or for collaborative drug management or comprehensive medication management; and

- a pharmacist dispensing non-patient specific prescriptions, including opioid antagonists, or prescriptions issued in response to a declared public health emergency.

This waiver is hereby issued for the ten above-listed exceptional circumstances and shall be effective from March 26, 2017, until March 25, 2018. Before March 25, 2018, the Commissioner of Health will determine whether the software available for electronic prescribing has sufficient functionality to accommodate each of these exceptional circumstances.

The Department further acknowledges that, while many nursing home/residential health care facilities have adopted electronic prescribing, there remain some facilities in which electronic prescribing may not be currently possible due to technological or economic issues or other exceptional circumstances, including a heavy reliance upon oral communications with the prescriber and pharmacy. For these reasons, pursuant to the authority in PHL § 281(3), and as directed by Governor Cuomo in Veto Message #218 of 2016, the Commissioner of Health will continue to waive from the requirements of electronic prescribing:

- a practitioner prescribing a controlled or non-controlled substance either through an Official New York State Prescription form or an oral prescription communicated to a pharmacist serving as a vendor of pharmaceutical services, by an agent who is a health care practitioner, for patients in nursing homes and residential health care facilities as defined by PHL § 2801; and

- a pharmacist serving as a vendor of pharmaceutical services dispensing a controlled or non-controlled substance through an Official New York State Prescription form or an oral prescription communicated by an agent who is a health care practitioner, for patients in nursing homes and residential health care facilities as defined by PHL § 2801.

This waiver is hereby issued for the above two exceptional circumstances involving nursing homes and residential health care facilities, as defined by PHL § 2801, and shall be effective from March 26 through October 31, 2017.

Practitioners issuing prescriptions in all of the above-listed exceptional circumstances may use either the Official New York State Prescription Form or issue an oral prescription, provided, however, that oral prescriptions remain subject to PHL §§ 3334 and 3337, which provide for oral prescriptions of controlled substances in emergencies and for other limited prescriptions issued on the Official New York State Prescription Form or oral prescriptions in all of the above-listed exceptional circumstances.

The above blanket waivers shall not affect other general waivers the Department issues to practitioners pursuant to PHL § 281.

For additional information regarding e-prescribing, visit the Bureau of Narcotic Enforcement's webpage at: http://www.health.ny.gov/professionals/narcotic/electronic_prescribing/.

Attention Family Planning Providers: Medicaid-covered Long Acting Reversible Contraceptives

| LARC Description | Procedure Code |

|---|---|

| Levonorgestrel-releasing intrauterine contraceptive system, 52 mg, 3-year duration (Liletta) | J7297 |

| Levonorgestrel-releasing intrauterine contraceptive system, 52 mg, 5-year duration (Mirena) | J7298 |

| Intrauterine copper contraceptive (Paragard) | J7300 |

| Levonorgestrel-releasing intrauterine contraceptive system, 13.5 mg, 3-year duration (Skyla) | J7301 |

| Etonogestrel (contraceptive) implant system, including implant and supplies (Implanon or Nexplanon) | J7307 |

The New York State Medicaid program provides coverage for FDA-approved birth control methods, devices, and supplies (e.g., birth control pills, injectables, patches, condoms, diaphragms, implantables, and intrauterine devices (IUDs)). Long-acting reversible contraceptives (LARCs), such as IUDs and contraceptive implants, are the most effective forms of contraceptives. One major advantage of LARCs is that they do not require ongoing effort on the part of the user for long-term and effective use. More than 22,000 fee-for-service (FFS) Medicaid members chose LARC as their method of birth control since April 1, 2015.

Fee-for-Service LARC Reimbursement Facts

Prior approval is not required for any LARC or other birth control method, device, or supply covered by New York State FFS Medicaid. Medicaid FFS reimbursement for LARC is based on the provider's actual invoiced acquisition cost. Please see the article, Reasonability Edits for Practitioner-Administered Drugs, published in the August 2015 Medicaid Update, for important claims processing rules here: http://www.health.ny.gov/health_care/medicaid/program/update/2015/2015-08.htm#edi.

IUDs and contraceptive implants are not available to Medicaid FFS members through a pharmacy, as the New York State Medicaid pharmacy formulary does not include LARCs, nor are the devices covered as Medical/Surgical Supplies.

Hospital outpatient department clinics and free standing diagnostic treatment center clinics with the designated category of service of 0163 (ordered ambulatory diagnostic and treatment center) or 0282 (hospital based ordered ambulatory) may bill the invoiced LARC cost as an ordered ambulatory service. The cost of LARC is carved-out of Ambulatory Patient Group (APG) facility reimbursement and Federally qualified health centers prospective payment system reimbursement.

Effective April 1, 2014 hospitals may bill Medicaid FFS for the cost of the LARC provided to Medicaid FFS members during their postpartum inpatient hospital stay. LARCs provided during this inpatient stay can be billed to Medicaid on an ordered ambulatory claim, separate from the inpatient claim. Additional information is available online at: https://www.emedny.org/Listserv/Inpatient/Inpatient_Clarification_on_Reimbursement_for_LARC_Provided_as_an_Inpatient_Post-Partum_Svc_4-9-15.pdf.

Effective May 1, 2014, Medicaid Managed Care (MMC) plans were encouraged to accommodate and promote coverage of LARC provided to women during their postpartum inpatient hospital stay. Effective September 1, 2016, the Department of Health requires MMC plans to implement mechanisms to pay hospitals for immediate postpartum LARC separately from reimbursement for the inpatient stay.

The purchase, insertion, and removal of an IUD or contraceptive implant is included within the practitioner or clinic visit as a covered service through the enrollee's Medicaid managed care plan. In cases where the enrollee's plan does not cover family planning services (such as the New York State Catholic Health Plan, dba Fidelis Care New York), the family planning services may be billed to NYS FFS Medicaid. Additional information can be found online at:https://www.health.ny.gov/health_care/medicaid/program/update/2016/2016-09.htm#larc_coverage.

NYS FFS Medicaid billing guidelines for IUDs and contraceptive implants can be found in the applicable provider policy and billing manuals online at: http://www.eMedNY.org. Policy questions regarding Medicaid FFS may be directed to Office of Health Insurance Programs, Division of Program Development and Management at (518) 473–2160. Questions on billing or claims should be directed to the eMedNY Call Center at 1-800-343-9000.

Update on the Smoking Cessation Benefit in Medicaid Fee-for-Service and Medicaid Managed Care

Effective December 1, 2016, Medicaid FFS and Medicaid Managed Care (MMC) have now aligned criteria to provide the following Smoking Cessation Benefit to all Medicaid members:

- Removed the two-course annual limit for smoking cessation agents

- Removed Prior Authorization of smoking cessation agents (exceptions would apply for brand name medications with generic equivalents available)

- Include formulary coverage of all smoking cessation agents (exceptions would apply for brand name medications with generic equivalents available)

- Allow concomitant utilization of 2 agents

- Follow FDA approved/Compendia supported limits for Age Restrictions

- Follow FDA approved/Compendia supported Quantity Limits

These changes came about as a collaborative effort between the Department of Health, Office of Alcoholism and Substance Abuse Services and the Office of Mental Health to reduce tobacco use, beginning with the Behavioral Health Transition to Managed Care:http://www.health.ny.gov/health_care/medicaid/redesign/behavioral_health/, the Centers for Disease Control and Prevention 6/18 Initiative: https://www.cdc.gov/sixeighteen/ and as part of the NYS Department of Health Prevention Agenda: http://www.health.ny.gov/prevention/tobacco_control/.

The Department of Health, in working with our Managed Care partners, was able to open up this benefit to all Medicaid members. The NYS MMC Pharmacy Benefit Information Center contains easy access to this and additional formulary information for the MMC plans and can be found at the following website: http://mmcdruginformation.nysdoh.suny.edu/.

For additional support in implementing best practices in tobacco dependence treatment, information can be found at the following DOH website: https://talktoyourpatients.health.ny.gov/. U.S. Public Health Service Clinical Guidelines for Treating Tobacco Use and Dependence: 2008 Update can be found here: https://bphc.hrsa.gov/buckets/treatingtobacco.pdf.

Further educational resources and accreditation on smoking cessation can be found on the NYS Medicaid Prescriber Education Program website at: https://nypep.nysdoh.suny.edu/CME-NicotineDependence-Information.html.

2017 Spousal Impoverishment Income and Resource Levels Increase

Providers of nursing facility services, home and community based waiver services and services to individuals enrolled in a managed long term care plan, are required to print and distribute the "Information Notice to Couples with an Institutionalized Spouse" at the time they begin to provide services to their patients.

Effective January 1, 2017, the federal maximum community spouse resource allowance increases to $120,900 while the community spouse income allowance increases to $3,022.50. The maximum family member monthly allowance increases to $677.

This information should be provided to any institutionalized spouse, community spouse, or representative acting on their behalf so as to avoid unnecessary depletion of the amount of assets a couple can retain under the spousal impoverishment eligibility provisions.

| Date | Allowance |

|---|---|

| January 1, 2017 | Federal Maximum Community Spouse Resource Allowance: $120,900 Note: A higher amount may be established by court order or fair hearing to generate income to raise the community spouse's monthly income up to the maximum allowance. Note: The State Minimum Community Spouse Resource Allowance is $74,820. |

| January 1, 2017 | Community Spouse Minimum Monthly Maintenance Needs Allowance is an amount up to: $3,022.50 (if the community spouse has no income of his/her own) Note: A higher amount may be established by court order or fair hearing due to exceptional circumstances that result in significant financial distress. |

| January 1, 2017 | Family Member Monthly Allowance for each family member is an amount up to: $677 (if the family member has no income of his/her own) |

Note: If the institutionalized spouse is receiving Medicaid, any change in income of the institutionalized spouse, the community spouse, and/or the family member may affect the community spouse income allowance and/or the family member allowance. Therefore, the social services district should be promptly notified of any income variations.

Information Notice to Couples with an Institutionalized Spouse

- "Information Notice to Couples with an Institutionalized Spouse" is available as a PDF.

- Additionally, the form Request for Assessment should be printed and distributed.

Medicaid is an assistance program that may help pay for the costs of your or your spouse's institutional care, home and community based waiver services, or enrollment in a managed long term care plan. The institutionalized spouse is considered medically needy if his/her resources are at or below a certain level and the monthly income after certain deductions is less than the cost of care in the facility.

Federal and State laws require that spousal impoverishment rules be used to determine an institutionalized spouse's eligibility for Medicaid. These rules protect some of the income and resources of the couple for the community spouse.

Note: Spousal impoverishment rules do not apply to an institutionalized spouse who is eligible under the Modified Adjusted Gross Income (MAGI) rules.

If you or your spouse are:

- In a medical institution or nursing facility and are likely to remain there for at least 30 consecutive days; or

- Receiving home and community based services provided pursuant to a waiver under section 1915(c) of the federal Social Security Act and are likely to receive such services for at least 30 consecutive days; or

- Receiving institutional or non-institutional services and are enrolled in a managed long term care plan; and

- Married to a spouse who does not meet any of the criteria set forth under (1) through (3), these income and resource eligibility rules for an institutionalized spouse may apply to you or your spouse.

If you wish to discuss these eligibility provisions, please contact your local department of social services. Even if you have no intention of pursuing a Medicaid application, you are urged to contact your local department of social services to request an assessment of the total value of your and your spouse's combined countable resources. It is to the advantage of the community spouse to request such an assessment to make certain that allowable resources are not depleted by you for your spouse's cost of care. To request such an assessment, please contact your local department of social services or mail a completed "Request for Assessment Form." New York City residents may contact the Human Resources Administration (HRA) Infoline at (718) 557–1399.

Information about resources:

Effective January 1, 1996, the community spouse is allowed to keep resources in an amount equal to the greater of the following amounts:

- $74,820 (the State minimum spousal resource standard); or

- The amount of the spousal share up to the maximum amount permitted under federal law ($120,900 for 2017).

For purposes of this calculation, "spousal share" is the amount equal to one-half of the total value of the countable resources of you and your spouse at the beginning of the most recent continuous period of institutionalization of the institutionalized spouse. The most recent continuous period of institutionalization is defined as the most recent period you or your spouse met the criteria listed in items 1 through 4 (under "If you or your spouse are:"). In determining the total value of the countable resources, we will not count the value of your home, household items, personal property, your car, or certain funds established for burial expenses.

The community spouse may be able to obtain additional amounts of resources to generate income when the otherwise available income of the community spouse, together with the income allowance from the institutionalized spouse, is less than the maximum community spouse monthly income allowance, by requesting a fair hearing or commencing a family court proceeding against the institutionalized spouse. Your attorney or local Office for the Aging can provide you with more information.

Either spouse or a representative acting on their behalf may request an assessment of the couple's countable resources, at the beginning, or any time after the beginning of a continuous period of institutionalization. Upon receipt of such request and all relevant documentation, the local district will assess and document the total value of the couple's countable resources and provide each spouse with a copy of the assessment and the documentation upon which it is based. If the request is not filed with a Medicaid application, the local department of social services may charge up to $25.00 for the cost of preparing and copying the assessment and documentation.

Information about income:

You may request an assessment/determination of:

- The community spouse monthly income allowance (an amount of up to $3,022.50 a month for 2017); and

- A maximum family member allowance for each minor child, dependent child, dependent parent or dependent sibling of either spouse living with the community spouse of $677 for 2017 (if the family member has no income of his/her own).

The community spouse may be able to obtain additional amounts of the institutionalized spouse's income, due to exceptional circumstances resulting in significant financial distress, then would otherwise be allowed under the Medicaid program, by requesting a fair hearing or commencing a family court proceeding against the institutionalized spouse. Significant financial distress means exceptional expenses which the community spouse cannot be expected to meet from the monthly maintenance needs allowance or from amounts held in resources. These expenses may include, but are not limited to: recurring or extraordinary non-covered medical expenses (of the community spouse or dependent family members who live with the community spouse); amounts to preserve, maintain, or make major repairs to the home; and amounts necessary to preserve an income-producing asset. Social Services Law 366-c(2)(g) and 366-c(4)(b) require that the amount of such support orders be deducted from the institutionalized spouse's income for eligibility purposes. Such court orders are only effective back to the filing date of the petition. Please contact your attorney or local Office for the Aging for additional information.

If you wish to request an assessment of the total value of your and your spouse's countable resources, a determination of the community spouse resource allowance, community spouse monthly income allowance, or family member allowance(s) and the method of computing such allowances, please contact your local department of social services. New York City residents should call the Human Resources Administration (HRA) Infoline at (718) 557–1399.

Additional Information

For purposes of determining Medicaid eligibility for the institutionalized spouse, a community spouse must cooperate by providing necessary information about his/her resources. Refusal to provide the necessary information shall be reason for denying Medicaid for the institutionalized spouse because Medicaid eligibility cannot be determined. If denial of Medicaid would result in undue hardship for the institutionalized spouse and an assignment of support is executed or the institutionalized spouse is unable to execute such assignment due to physical or mental impairment, Medicaid shall be authorized. However, if the community spouse refuses to make such resource information available, then the Department, at its option, may refer the matter to court.

Undue hardship occurs when:

- A community spouse fails or refuses to cooperate in providing necessary information about his/her resources;

- The institutionalized spouse is otherwise eligible for Medicaid;

- The institutionalized spouse is unable to obtain appropriate medical care without the provision of Medicaid; and

- The community spouse's whereabouts are unknown; or

- The community spouse is incapable of providing the required information due to illness or mental incapacity; or

- The community spouse lived apart from the institutionalized spouse immediately prior to institutionalization; or

- Due to the action or inaction of the community spouse, other than the failure or refusal to cooperate in providing necessary information about his/her resources, the institutionalized spouse will be in need of protection from actual or threatened harm, neglect, or hazardous conditions if discharged from appropriate medical setting.

An institutionalized spouse will not be determined ineligible for Medicaid because the community spouse refuses to make his or her resources in excess of the community spouse resource allowance available to the institutionalized spouse if:

- The institutionalized spouse executes an assignment of support from the community spouse in favor of the social services district; or

- The institutionalized spouse is unable to execute such assignment due to physical or mental impairment.

Contribution from Community Spouse

The amount of money that we will request as a contribution from the community spouse will be based on his/her income and the number of certain individuals in the community depending on that income. We will request a contribution from a community spouse of 25% of the amount his/her otherwise available income that exceeds the minimum monthly maintenance needs allowance plus any family member allowance(s). If the community spouse feels that he/she cannot contribute the amount requested, he/she has the right to schedule a conference with the local department of social services to try to reach an agreement about the amount he/she is able to pay.

Pursuant to Section 366(3)(a) of the Social Services Law, Medicaid MUST be provided to the institutionalized spouse, if the community spouse fails or refuses to contribute his/her income towards the institutionalized spouse's cost of care. However, if the community spouse fails or refuses to make his/her income available as requested, then the Department, at its option, may refer the matter to court for a review of the spouse's actual ability to pay.

NY Medicaid EHR Incentive Program Update

The NY Medicaid Electronic Health Records (EHR) Incentive Program provides financial incentives to eligible professionals and hospitals to promote the transition to EHRs. Providers who practice using EHRs are in the forefront of improving quality, reducing costs and addressing health disparities. Since December 2011, over $784 million in incentive funds have been distributed within 24,999 payments to New York State Medicaid providers.

24,999

Payments

$784+

Million Paid

Are you eligible? For more information, visit http://www.health.ny.gov/ehr

MEIPASS Open for Meaningful Use

The NY Medicaid EHR Incentive Program Administrative Support Service (MEIPASS) is now open and is accepting attestations for 2015 and 2016 meaningful use (MU) and 2016 Adopt, Implement, Upgrade (AIU). The final deadlines have been extended and are listed below.

- 2016 AIU deadline: 5/31/17

- 2015 MU deadline: 6/30/17

- 2016 MU deadline: 9/15/17

Resources

The NY Medicaid EHR Incentive Program website (http://www.health.ny.gov/health_care/medicaid/redesign/ehr/) now has recorded video tutorials available for on-demand assistance. The interactive tutorials are instructor-led with step-by-step guidance to assist with completing your MU attestation. Visit the Tutorials page here: http://www.health.ny.gov/health_care/medicaid/redesign/ehr/tutorials.htm, to access these videos.

Preparing to Attest

- Verify your FFS Medicaid enrollment at: https://www.emedny.org/.

- Verify your CMS Registration is up to date at: https://ehrincentives.cms.gov/hitech/login.action.

- Obtain your EHR certification ID from the Certified Health Product List (CHPL) website here: chpl.healthit.gov.

- Maintain your Electronic/Paper Transmitter Identification Number (ETIN) certification by filling out this form: https://www.emedny.org/info/ProviderEnrollment/ProviderMaintForms/490501_ETIN_CERT_Certification_Statement_Cert_Instructions_for_Existing_ETINs.pdf.

- Grant MEIPASS access privileges in your ePACES account at: https://www.emedny.org/epaces/.

Questions? Contact NY Medicaid EHR Incentive Program Support at hit@health.ny.gov.

Need Assistance?

In addition to the NY Medicaid EHR Incentive Program Support Team, who can be reached via phone at 877-646-5410 or via email at hit@health.ny.gov, there are two Regional Extension Centers (RECs) available to assist you.

EPs in New York City can contact NYC REACH at 347-396-4888 or pcip@health.nyc.gov.

EPs outside of New York City can contact NYeC at 646-619-6400 or hapsinfo@nyehealth.org.

Questions? Contact hit@health.ny.gov for program clarifications and details.

Attention Care at Home Waiver III, IV, and VI Case Management Providers: New Billing Guidance Effective for Dates of Service Beginning April 1, 2017

Effective January 20, 2017, the Centers for Medicare and Medicaid Services (CMS) approved the consolidation of the Care at Home (CAH) III, IV, and VI waivers into the "Office for People With Developmental Disabilities Care at Home Waiver." The new waiver will continue to serve medically fragile children under the age of eighteen (18) who have a developmental disability and live at home with their parent(s) or legal guardian(s). The purpose of the consolidation is to streamline and strengthen New York State's administrative oversight and reporting mechanisms for these waiver programs.

Children who are currently enrolled under the CAH III, CAH IV or CAH VI Waivers, and who continued to meet eligibility requirements as of January 20, 2017 are automatically included in the new consolidated waiver. There will be no disruption in services for children served under the OPWDD Care at Home Waiver.

Effective for dates of service beginning April 1, 2017, all CAH case management services must be billed using the following rate codes, regardless of which waiver the child was enrolled in prior to April 1, 2017:

| Rate Code | Service |

|---|---|

| Rate Code 2326 | OPWDD CAH Case Management Initial This new "transition services" rate code is billable only during the first month of the child's enrollment in the waiver. This special higher transition rate reflects reimbursement for the additional workload associated with CAH waiver enrollment and plan development activities and is only to be used for the child's initial participation in a waiver program. This rate includes all intake and screening activities, preparation or coordination of all enrollment documents, and development of the initial plan of services (Plan of Care). The case manager must have face-to-face contact with the child in order to develop the initial plan of care. Billing of rate code 2326 is allowed once per lifetime. No additional CAH case management billings can occur in the first month of waiver enrollment. |

| Rate Code 2320 | OPWDD CAH Case Management Per Diem This new "face-to-face services" rate code is billable once monthly and reimburses all case management activities necessary for the provision of the required monthly face-to-face contact with the child. In order to bill for the monthly service, the case manager must have direct face-to-face contact with the child. Billing of rate code 2320 is allowed once per month, starting in the second month of waiver enrollment. |

| Rate Code 2311 | OPWDD CAH Case Management 1/4 Hour Ongoing routine case management activities that do not involve a face-to-face service will continue to be reimbursed on a per-unit basis. This reimbursement allows for the provision of additional support services necessary to ensure the health and safety of the child, and to support service plan development. Billing of rate code 2311 is capped at eight (8) units per month. Services are billed in units of fifteen minute intervals and should be calculated as follows:

|

Please refer to the October 27, 2014 GIS located here: https://www.health.ny.gov/health_care/medicaid/publications/gis/14ma023.htm, for additional information pertaining to acceptable case management billing practices and documentation requirements.

Claims submitted for case management services under the CAH III waiver (rate code 2305) or CAH VI waiver (rate code 2317) for services provided on or after April 1, 2017 will be denied. In addition, beginning April 1, 2017, there will be one Restriction/Exception Code (R/E code) used for all children receiving OPWDD CAH services. The R/E code to be used is 65, which is the current R/E code for CAH IV. R/E codes 64 (CAH III) and 67 (CAH VI) will no longer be valid. R/E codes for children enrolled in CAH III and CAH VI on April 1, 2017 will be automatically changed to R/E code 65.

Medicaid Pharmacy Prior Authorization Programs Update

On February 16, 2017, the New York State Medicaid Drug Utilization Review (DUR) Board recommended changes to the Medicaid pharmacy prior authorization programs. The Commissioner of Health has reviewed the recommendations of the Board and has approved changes to the Preferred Drug Program (PDP) within the fee-for-service (FFS) pharmacy program. Effective April 20, 2017, the FFS pharmacy program will implement the following parameters recommended by the DUR Board:

- Anti-Retroviral (ARV) Drug Interaction Updates: Update system edits to include severity level 1 drug-drug interactions consistent with FDA (ARV) labeling.

- Zolpidem Clinical Updates: Ensure edits for zolpidem dosages are consistent with FDA labeling inclusive of dosing parameters. Dosing inconsistent with FDA labeling may require prescriber involvement.

For more detailed information on the above DUR Board recommendations, please refer to the meeting summary at: http://www.health.ny.gov/health_care/medicaid/program/dur/.

The most up-to-date information on the Medicaid FFS Pharmacy Prior Authorization (PA) Programs and a full listing of drugs subject to the Medicaid FFS Pharmacy Programs can be found at: https://newyork.fhsc.com/downloads/providers/NYRx_PDP_PDL.pdf. To obtain a PA, please contact the clinical call center at 1-877-309-9493. The clinical call center is available 24 hours per day, 7 days per week with pharmacy technicians and pharmacists who will work with you, or your agent, to quickly obtain a PA.

Medicaid enrolled prescribers can also initiate PA requests using a web-based application. PAXpress® is a web based pharmacy PA request/response application accessible through a new button "PAXpress" located on eMedNY.org under the MEIPASS button.

Additional information, such as the Medicaid Standardized PA form and clinical criteria are available at the following websites: http://www.health.ny.gov or http://newyork.fhsc.com orhttp://www.eMedNY.org.

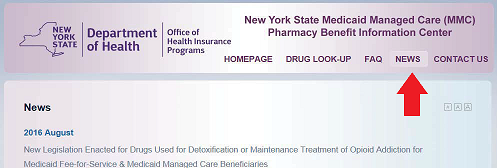

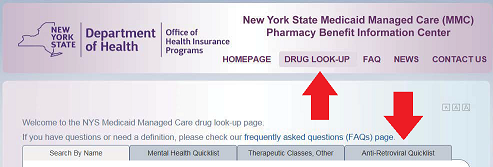

New York State Medicaid Managed Care Pharmacy Benefit Information Website Update

The New York State Department of Health in partnership with the State University of New York at Stony Brook continue to add new features to the New York State Medicaid Managed Care (MMC) Pharmacy Benefit Information Website. The most recent update, occurring in February 2017, includes the addition of a News tab as well as Anti-Retroviral drug look up lists by therapeutic class.

The News tab includes links to Medicaid Update articles relevant to Medicaid Managed Care as well as links to other related sites.

The Anti-Retroviral look up lists can be found in the Drug Look-Up section.

The Medicaid Managed Care Pharmacy Benefit Information website is available at:

http://mmcdruginformation.nysdoh.suny.edu/. Note this is a new URL. Users accessing the site with the old URL will be redirected.

In addition, you can link to the website from the following pages:

- New York State Department of Health Medicaid Managed Care Page: http://www.health.ny.gov/health_care/managed_care/. Click on Medicaid Managed Care Pharmacy Benefit Information Center.

- The eMedNY home page under "Featured Links" at: https://www.emedny.org/index.aspx. Click on New York State Medicaid Managed Care Pharmacy Benefit Information Center.

- Under Supplemental Information on Specific MRT Proposals: http://www.health.ny.gov/health_care/medicaid/redesign/supplemental_info_mrt_proposals.htm. Click on MRT 11 & MRT 15: Pharmacy Related Proposals and then click on Managed Care Plan Pharmacy Benefit Manager and Formulary Information.

Update: Emergency Contraceptive Coverage

Both prescription and over-the-counter (OTC) Emergency Contraception is a Covered Benefit for all Medicaid Fee-for-Service and Managed Care enrollees.

In accordance with Title 18 of NY Codes, Rules and Regulations 505.3, non-prescription (Over-the-Counter, OTC) emergency contraceptive drugs can be obtained without a written order from a practitioner.

Effective March 1, 2017, NYS Medicaid has eliminated age restrictions when dispensing non-prescription emergency contraceptive drugs without a written order, per FDA guidelines.

Prescription-only contraceptive drugs continue to require a practitioner order. For Medicaid eligible females, a fiscal order or prescription is not required for non-prescription (OTC) emergency contraception. Limited to six courses of therapy in a 12-month period.

Medicaid Fee for Service Billing

When dispensing these products without a written/electronic/oral order, the prescriber identification field for pharmacy claims may be left blank and the claim will still be processed.

Managed Care Plan Billing

For information on the billing to managed care plans for emergency contraception for Medicaid managed members without a written order, please check with the individual managed care plan. Contact information is available at: http://mmcdruginformation.nysdoh.suny.edu/. (Click on a plan card for their specific contact information.)

Appendix: Request for Assessment Form

The Request for Assessment Form is available for download and print at: http://www.health.ny.gov/health_care/medicaid/program/update/2014/request_assessment_form .pdf.

The Medicaid Update is a monthly publication of the New York State Department of Health.

Andrew M. Cuomo

Governor

State of New York

Howard A. Zucker, M.D., J.D.

Commissioner

New York State Department of Health

Jason A. Helgerson

Medicaid Director

Office of Health Insurance Programs