April 2009 Volume 25, Number 5

New York State Medicaid Update

The official newsletter of the New York Medicaid Program

David A. Paterson, Governor

State of New York

Richard F. Daines, M.D. Commissioner

New York State Department of Health

Deborah Bachrach, Deputy Commissioner

Office of Health Insurance Programs

Dear Medicaid Provider,

Welcome to the April 2009 Medicaid Update newsletter. In addition to policy and billing updates, this edition includes a message from our Medical Director regarding important new coverage guidelines for blood glucose testing supplies.

Also, included at the end of this Update is an addendum for nursing facilities and certain home and community based waiver service providers with information about 2009 spousal impoverishment income and resource levels.

The Medicaid Update is a monthly publication of the New York State Department of Health and contains information regarding the care of those enrolled in the Medicaid program.

In this issue....

POLICY AND BILLING GUIDANCE

APG Implementation Delayed for Diagnostic and Treatment Centers

New York State Benefit Identification Card Undergoes Changes

Coverage of Viral Tropism Tests for Managed Care Enrollees

New Edit Change - Home Health and Personal Care Providers

Changes to Medicaid Outpatient Clinic Code Editing

PHARMACY PROVIDERS

Mandatory Generic Drug Program Update

Medicare Coverage of Immunosuppressant Drugs

Reminder: Second Generation Antihistamines

Frequency Guidelines for Blood Glucose Testing

NEWS FOR ALL PROVIDERS

Web-Based Continuing Medical Education Courses Available for Psychotropic Prescribing

Smoking Cessation Advertisement

CSC offers Medicaid Provider Seminars

HOME HEALTH AND PERSONAL CARE PROVIDERS

Home Health and Personal Care Providers Notice

2009 Spousal Impoverishment Income and Resource Levels Increase

Information Notice to Couples with an Institutionalized Spouse

Request for Assessment Form

PROVIDER DIRECTORY

Is Your E-mail Address Up To Date?

Please notify us immediately if your e-mail address changes so that we may continue to keep you apprised of current Medicaid policy guidelines and bulletins. It is the responsibility of each provider to alert Medicaid of any address or e-mail changes as soon as they occur. Please send your new information to medicaidupdate@health.state.ny.us. Thank you for your continued feedback.

State Health Department selects hospitals to provide breast cancer surgery to Medicaid patients

Return to Table of Contents

Recent medical peer-review literature cites the association between higher breast cancer surgery volume and higher rates of five-year survival.

Effective March 1, 2009, Medicaid no longer pays for inpatient or outpatient mastectomy and lumpectomy procedures associated with breast cancer at low-volume hospitals and ambulatory surgery centers. A low-volume facility is defined as performing less than 30 all payer mastectomy and lumpectomy procedures per year for breast cancer.

The exclusion of these breast cancer surgeries does not restrict a facility's ability to provide diagnostic or and post surgical care (chemotherapy, radiation, reconstruction, etc.) to Medicaid patients.

The Department will annually re-examine surgery volume and will modify the list of hospitals and ambulatory surgery centers with which Medicaid will contract for such surgery accordingly. This policy applies to both Medicaid fee-for-service and Medicaid managed care.

For more information and a listing of the hospitals that are authorized to continue providing breast cancer surgery to New York Medicaid patients, please visit: http://www.nyhealth.gov/press/releases/2009/hospitals_and_ascs_approved_for_breast_cancer_surgery.htm

For a copy of the study published in the American Journal of Public Health, please visit: http://www.ajph.org/cgi/reprint/88/3/454

Do you have article recommendations or information you would like to see in a future Medicaid Update? Please send your suggestions to medicaidupdate@health.state.ny.us

Policy and Billing Guidance Bulletins

APG Implementation Delayed for Diagnostic and Treatment Centers

Return to Table of Contents

Implementation of the Ambulatory Patient Groups (APGs) payment methodology in Diagnostic and Treatment Centers (DT&Cs) including free-standing ambulatory surgery centers is delayed pending federal approval. DT&C providers should continue to submit claims for outpatient services to eMedNY using existing rate codes (not APG rate codes) until further notice. For updates on the D&TC APG implementation schedule, please watch for future Medicaid Update articles and visit the Department's APG Website at: http://www.health.state.ny.us/health_care/medicaid/rates/apg/index.htm

The New York State Benefit Identification Card is Changing

Return to Table of Contents

In an effort to increase program integrity, changes are being made to the New York State Common Benefit Identification Card (CBIC). Currently, if a Medicaid beneficiary presents more than one CBIC at the point of service, the most recently issued card is identified by the SEQUENCE NUMBER (SEQ).

Effective May 2009, chronological SEQs will be replaced with randomly generated SEQs. Medicaid beneficiaries will be instructed when they receive a new CBIC that it must be presented so that providers may verify coverage and bill appropriately for covered services.

A DATE and TIME stamp will be included on the top of all new and replacement CBICs issued beginning in April 2009 to help identify the most recently issued card. A mass mailing of new cards for current beneficiaries is not planned. Rather, the changes will be made at the time a replacement card is issued or when new cards are generated at initial case opening.

Coverage of Viral Tropism Tests for Managed Care Enrollees

Return to Table of Contents

Viral tropism tests are reimbursable through Medicaid fee-for-service using procedure code 87999 for Medicaid managed care enrollees. For Family Health Plus enrollees, these tests must be billed to the enrollee's health plan. Viral tropism testing identifies patients who are likely to respond to the new HIV entry inhibitor drug, Selzentry. Currently, one testing method (Trofile assay) is eligible for coverage.

For more information about Medicaid coverage of viral tropism laboratory tests, please see article "Medicaid Now Reimbursing for Viral Tropism Laboratory Test" in the June 2008 Medicaid Update.

Home Health and Personal Care Providers - New Edit Change

Return to Table of Contents

Effective May 1, 2009, providers will receive an error message for Edit 00760 (Suspect Duplicate, covered by Inpatient Claim) when they submit home health and personal care claims for a period when a patient is hospitalized and the services are covered under the inpatient rate. Please contact the eMedNY Call Center at (800) 343-9000 with any questions.

Policy and Billing Guidance

Changes to Outpatient Clinic Code Editing

Return to Table of Contents

The Department has been working to increase the reliability and validity of diagnosis and procedure code reporting on outpatient clinic claims submitted to Medicaid for reimbursement, including those submitted for hospital outpatient, freestanding clinic, emergency department, and ambulatory surgery services.

________________________________________________

Effective with claims submitted on and after June 1, 2009, the following five edits will be reset from Pay and Report to Deny:

- 00070 Procedure Code Invalid

- 00148 Secondary Diagnosis Not on File

- 00170 Procedure Code Not on File

- 00218 Procedure Code Invalid for Category of Service

- 01005 Through Service Date After Bill Date

________________________________________________

Later this summer the following seven edits will be set to Pay and Report while the Department assesses their impact. Barring any unintended consequences, the edits will ultimately be reset to Deny.

- 00165 Recipient Age Exceeds Maximum (Pend)

- 00167 Recipient Age Less Than Minimum for Procedure (Pend)

- 00178 Procedure Code Invalid for Sex Pend

- 00204 Procedure Code Inactive for Date of Service

- 00266 Recipient Age Exceeds Maximum for Procedure

- 00268 Recipient Age Less Than Minimum for Procedure

- 00289 Procedure Code Invalid for Sex

Please contact the eMedNY Call Center at (800) 343-9000 with any questions.

Pharmacy Providers

Mandatory Generic Drug Program Update

The New York State Medicaid Mandatory Generic Drug Program requires prior authorization

for brand-name prescriptions with an A-rated generic equivalent.

Return to Table of Contents

| Effective May 15, 2009, new prescriptions for the brand-name drugs listed below will require prior authorization: | |

|---|---|

| ACTIVELLA 1.0-0.5 MG TABLET | KYTRIL 1MG/ML VIAL |

| AUGMENTIN ES-600 SUSPENSION | LOCOID 0.1% CREAM |

| COLESTID 1 GM TABLET | MINITRAN 0.1 MG/HR, 0.4MG/HR, 0.6MG/HR PATCH |

| CORMAX 0.05% SOLUTION | NITRO-DUR 0.1 MG/HR, 0.4MG/HR, 0.6MG/HR PATCH |

| DDAVP 4 MCG/ML AMPUL | REQUIP 0.25 MG, 0.5 MG, 1 MG, 2 MG, 3 MG, 4 MG TAB |

| DELATESTRYL 200 MG/ML VIAL | RISPERDAL 0.25 MG. 0.5 MG, 1 MG, 2 MG, 3 MG, 4 MG TAB |

| DEPAKOTE 125 MG, 250 MG, 500 MG TABLET EC | ROCALTROL 1 MCG/ML ORAL SOLN |

| DERMATOP 0.1% CREAM | TEMOVATE 0.05% SOLUTION |

| DILAUDID-HP 10 MG/ML AMPUL AND VIAL | ZOFRAN 4 MG/2 ML VIAL |

| EFFEXOR 25 MG, 37.5 MG, 50 MG, 75 MG, 100 MG TAB | |

Prescriptions written prior to May 15, 2009, but filled on or after this date, including refills, will not require prior authorization. However, when the current prescription expires, a prior authorization will be required for the patient to continue to receive the brand-name drug.

- PLEASE NOTE: Brand-name drugs that are on the Medicaid Preferred Drug List do not require prior authorization and are not subject to the Medicaid Mandatory Generic Drug Program prior authorization requirements.

For pharmacy billing questions, please call (800) 343-9000. For Medicaid pharmacy policy questions, please call (518) 486-3209.

Reminder

Immunosuppressant Drugs for Persons

Eligible for Both Medicare and Medicaid Must Be Billed to Medicare

Return to Table of Contents

Medicare Part B covers drugs used in immunosuppressive therapy for enrollees covered by both Medicare and Medicaid only when Medicare approved the transplant; otherwise, the beneficiary's Part D plan should be billed. The Medicare Part D plan may require prior additional information, such as treatment diagnosis or Part B rejection status, before payment is made for these drugs.

Pharmacists: Billing Immunosuppressant Drugs with Multiple Indications

Part B should be billed for immunosuppressant drugs if the individual had a Medicare approved transplant, and the resulting deductible or coinsurance amounts should be billed to Medicaid. If it is not a Medicare approved transplant, the Part D plan may be billed for these drugs.

Articles published by CMS on Medicare B/D determinations are available for download at:

http://www.cms.hhs.gov/MLNMattersArticles/downloads/se0652.pdf

http://www.cms.hhs.gov/PrescriptionDrugCovContra/downloads/R2PDBv2.pdf

http://www.cms.hhs.gov/MLNMattersArticles/downloads/SE0570.pdf

For questions regarding coverage of immunosuppressant drugs by Medicare Part B or Part D, please contact the Part D plan or contact 1-800-MEDICARE.

Reminder: Second Generation Antihistamine

As allergy season draws near, we would like to remind you that the following second generation antihistamines are preferred and do not require prior authorization:

- OTC cetirizine

- OTC cetirizine-D

- OTC loratadine

- OTC loratadine-D

Although these medications are available over-the-counter, a fiscal order must be written for Medicaid and Family Health Plus coverage. The Medicaid Preferred Drug Program promotes the use of less expensive, equally effective prescription drugs when medically appropriate. For a complete listing of preferred agents in all therapeutic classes managed within the Preferred Drug Program, please review the NYS Medicaid Preferred Drug Quicklist which is available online at: https://newyork.fhsc.com/downloads/providers/NYRx_PDP_PDLquicklist.pdf

Additional information is available at: https://newyork.fhsc.com and http://www.nyhealth.gov

Frequency Guidelines for Blood Glucose Testing

MESSAGE FROM OUR MEDICAL DIRECTOR

DR. JAMES J. FIGGE

Return to Table of Contents

The value of intensive blood glucose control in patients with Type 1 diabetes has been demonstrated in major clinical trials, including the landmark Diabetes Control and Complications Trial(1). Assessment of glycemic control in Type 1 diabetes can be accomplished through measurement of the HbA1c and through patient self-monitoring of blood glucose (SMBG). Results of SMBG can be useful to both the patient and clinician in adjusting insulin doses, diet, and exercise to achieve the desired HbA1c target while minimizing hypoglycemia. SMBG is especially important for patients treated with insulin, and for most patients with Type 1 diabetes, SMBG is recommended three or more times daily by the American Diabetes Association(2). Type 1 or Type 2 diabetic patients who are treated using multiple daily insulin injections or the insulin pump are candidates for SMBG three or more times daily(2). The data are less clear regarding the utility of routine SMBG in patients with Type 2 diabetes who are not treated with insulin, and several recent studies have questioned the utility of SMBG in this population(3-5).

General Clinical Standards:

The most common range for testing blood glucose levels is 2-6 times per day. The lower end reflects individuals not on insulin or on a single daily injection while the higher end reflects those on more complex insulin therapy regimens. The American Diabetes Association guidelines specify that individuals using multiple daily injections of insulin or who are on insulin pump therapy should test their blood glucose levels 3 or more times per day. Some factors that determine how often a person with diabetes should test their blood glucose include the patient's age, their willingness to test, their use of insulin and their Hemoglobin A1C level.

Medicaid Reimbursement:

Effective for dates of service on and after April 1, 2009, fees for diabetic test strips and lancets have been adjusted and the maximum monthly quantities will change to 200 per month (equating to more than 6 tests per day):

| CODE | PRODUCT | QUANTITY (max per month) | REFILLS (max # of refills per script) | PRICE (per box) |

|---|---|---|---|---|

| A4253 | Blood Glucose Test or Reagent Strips for Home Blood Glucose Monitor, Per 50 Strips | 4 BOXES (200 strips) | 5 | $38.79 |

| A4259 | Lancets, Per Box of 100 | 2 BOXES (200 lancets) | 5 | $6.56 |

Ordering Supplies:

A fiscal order for medical-surgical supplies (e.g., blood glucose test strips and lancets) must be written for a one-month supply with a specified number of refills. Typically test strips are packaged and billed in a quantity of 50 and lancets, 100, and should be ordered accordingly.

Medical Override:

Although not common, some individuals with diabetes may require testing up to 8-12 times per day (250-350 strips per month), either for a short or long term period. For orders exceeding the maximum monthly quantity, prior approval is required for all lancets and strips dispensed on and after April 1, 2009. Please visit eMedNY.org for more information on how to obtain a Medical Override and submitting a prior authorization.

Refills:

A fiscal order for medical-surgical supplies may be refilled when the prescriber has indicated the number of refills and the beneficiary has requested the refill. Refills may be dispensed when one week or less remains on the current month's supply. Automatic refills are not permitted.

Delivery:

The DME or Pharmacy provider must first contact the beneficiary or representative to ensure that a delivery is required. A signed confirmation indicating delivery must be maintained in the patient record.

Questions?

Please contact the Division of Provider Relations and Utilization Management at (800) 342-3005, option 1.

NOTES:

(1) The effect of intensive treatment of diabetes on the development and progression of long-term complications in insulin-dependent diabetes mellitus. The Diabetes Control and Complications Trial Research Group. New England Journal of Medicine 329:977-986, 1993

(2) American Diabetes Association. Standards of Medical Care in Diabetes - 2009. Diabetes Care 32:S13-S61, 2009

(3) Farmer A, Wade A, Goyder E, Yudkin P, French D, Craven A, Holman R, Kinmonth AL, Neil A: Impact of self monitoring of blood glucose in the management of patients with non-insulin treated diabetes: open parallel group randomized trial. BMJ 335:132, 2007

(4) O'Kane MJ, Bunting B, Copeland M, Coates VE: Efficacy of self monitoring of blood glucose in patients with newly diagnosed type 2 diabetes (ESMON study): randomized controlled trial. BMJ 336:1174-1177, 2008

(5) Simon J, Gray A, Clarke P, Wade A, Neil A, Farmer A: Cost effectiveness of self monitoring of blood glucose in patients with non-insulin treated type 2 diabetes: economic evaluation of data from the Di-GEM trial. BMJ 336:1177-1180, 2008

All Providers

Improving Psychotropic Prescribing Practices in New York State

Web-based continuing medical education

courses available for psychotropic prescribing

Return to Table of Contents

As part of its continuing effort to improve psychotropic prescribing practices, the New York State Office of Mental Health (OMH) and the Department of Health (DOH) are now offering Web-based Continuing Medical Education (CME) courses.

This three-year initiative was implemented in Fall 2008 and is based on an initial set of quality indicators that include psychotropic polypharmacy and the use of antipsychotics with high or moderate risk of metabolic side effects for individuals with cardiometabolic risk factors.

The CME courses will offer clinical case examples and treatment recommendations. While these courses have been developed for prescribers, their content is available at no cost over the internet.

There are currently three CME courses offered. The first two cover cardiometabolic risk and psychotropic medication separately in adults and in youth. The third discusses psychotropic polypharmacy. Each course lasts roughly an hour, followed by a multiple choice quiz.

Maximum accreditation is 1.25 AMA PRA Category 1 credits for the youth course, and 1.00 AMA PRA Category 1 credits each for the adult cardiometabolic and for the psychotropic poypharmacy courses.

Future courses are currently being planned and will be announced soon.

Training videos and CME courses are available on-line at:

Cardiometablic (Youth): https://psyckesmedicaid.omh.state.ny.us/Common/CardiometabolicYouth.aspx

Cardiometabolic (Adult): https://psyckesmedicaid.omh.state.ny.us/Common/CardiometabolicAdult.aspx

Psychotropic Polypharmacy: https://psyckesmedicaid.omh.state.ny.us/Common/PolypharmacyCME.aspx

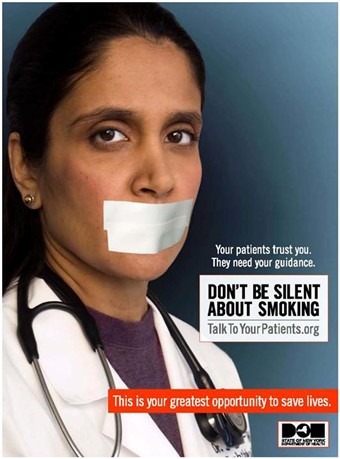

Smoking Cessation

Return to Table of Contents

By providing counseling, pharmacotherapy, and referrals,

you can double your patients' chances of successfully quitting.

For more information,

visit http://www.talktoyourpatients.org

or call the NY State Smokers' Quitline at 1-866-NY-QUITS (1-866-697-8487).

CSC offers Medicaid provider seminars

Return to Table of Contents

- Do you have billing questions?

- Are you new to Medicaid billing?

- Would you like to learn more about ePACES?

If you answered YES to any of these questions, you should consider registering for a Medicaid seminar. Computer Sciences Corporation (CSC) offers various types of seminars to providers and their billing staff. Many of the seminars planned for the upcoming months offer detailed information and instruction about Medicaid's Web-based billing and transaction program - ePACES.

ePACES is the electronic Provider Assisted Claim Entry System which allows enrolled providers to submit the following type of transactions:

- Claims

- Eligibility Verifications

- Utilization Threshold Service Authorizations

- Claim Status Requests

- Prior Approval Requests

Physicians, nurse practitioners and private duty nurses can even submit claims in "REAL-TIME" via ePACES. Real-time means that the claim is processed within seconds and professional providers can get the status of a real-time claim, including the paid amount without waiting for the remittance advice.

Fast and easy seminar registration, locations, and dates are available on the eMedNY Website at: http://www.emedny.org/training/index.aspx

Please review the seminar descriptions carefully to identify the seminar appropriate for your training requirements. Registration confirmation will instantly be sent to your e-mail address.

If you are unable to access the Internet to register, you may also request a list of seminars and registration information to be faxed to you through CSC-s Fax on Demand at (800) 370-5809.

Please request document 1001 for April - June seminar dates.

CSC Regional Representatives look forward to meeting with you at upcoming seminars!

Questions about registration? Please contact the eMedNY Call Center at (800) 343-9000.

Addendum

ATTENTION: PROVIDERS OF NURSING FACILITY SERVICES,

CERTAIN HOME AND COMMUNITY BASED WAIVER SERVICES AND SERVICES UNDER A PACE PROGRAM

2009 spousal impoverishment income and resource levels increase

Return to Table of Contents

Providers of nursing facility services, certain home and community based waiver services and services under a PACE program, are required to PRINT and DISTRIBUTE the "Information Notice to Couples with an Institutionalized Spouse" at the time they begin to provide services to their patients.

Effective January 1, 2009, the federal maximum community spouse resource allowance increased to $109,560 while the community spouse income allowance increased to $2,739. On February 1, 2009, the maximum family member monthly allowance increased to $608 monthly based on the 2009 Federal Poverty Levels.

This information should be provided to any institutionalized spouse, community spouse, or representative acting on their behalf so as to avoid unnecessary depletion of the amount of assets a couple can retain under the spousal impoverishment eligibility provisions.

INCOME AND RESOURCE AMOUNTS

January 1, 2009

Federal Maximum Community Spouse Resource Allowance: $109,560

NOTE: A higher amount may be established by court order or fair hearing to generate income to raise the community spouse's monthly income up to the maximum allowance. NOTE: The State Minimum Community Spouse Resource Allowance is $74,820.

January 1, 2009

Community Spouse Minimum Monthly Maintenance Needs Allowance is an amount up to: $2,739 (if the community spouse has no income of his/her own)

NOTE: A higher amount may be established by court order or fair hearing due to exceptional circumstances that result in significant financial distress.

February 1, 2009

Family Member Monthly Allowance for each family member is an amount up to: $608 (if the family member has no income of his/her own)

NOTE: If the institutionalized spouse is receiving Medicaid, any change in income of the institutionalized spouse, the community spouse, and/or the family member may affect the community spouse income allowance and/or the family member allowance. Therefore, the social services district should be promptly notified of any income variations.

Information Notice to Couples with an Institutionalized Spouse

Return to Table of Contents

Medicaid is an assistance program that may help pay for the costs of your or your spouse's institutional care, home and community based waiver services, or Program of All-inclusive Care for the Elderly (PACE) program. The institutionalized spouse is considered medically needy if his/her resources are at or below a certain level and the monthly income after certain deductions is less than the cost of care in the facility.

Federal and State laws require that spousal impoverishment rules be used to determine an institutionalized spouse's eligibility for Medicaid. These rules protect some of the income and resources of the couple for the community spouse.

If you or your spouse are:

(1) In a medical institution or nursing facility and is likely to remain there for at least 30 consecutive days; or

(2) Receiving home and community based services provided pursuant to a waiver under section 1915(c) of the federal Social Security Act and is likely to receive such services for at least 30 consecutive days; or

(3) Receiving institutional or non-institutional services under a PACE program as defined in sections 1934 and 1894 of the federal Social Security Act; AND

(4) Married to a spouse who does not meet any of the criteria set forth under (1) through (3), these income and resource eligibility rules for an institutionalized spouse may apply to you or your spouse.

If you wish to discuss these eligibility provisions, please contact your local department of social services. Even if you have no intention of pursuing a Medicaid application, you are urged to contact your local department of social services to request an assessment of the total value of your and your spouse's combined countable resources. It is to the advantage of the community spouse to request such an assessment to make certain that allowable resources are not depleted by you or your spouse's cost of care. To request such an assessment, please contact your local department of social services or mail the attached completed "Request for Assessment Form." New York City residents, calling from within New York City, should contact the Human Resources Administration (HRA) Infoline toll-free at (877) 472-8411. If calling from outside the five boroughs, the HRA Infoline number is (718) 557-1399.

Information about resources:

Effective January 1, 1996, the community spouse is allowed to keep resources in an amount equal to the greater of the following amounts:

(1) $74,820 (the State minimum spousal resource standard); or

(2) The amount of the spousal share up to the maximum amount permitted under federal law ($109,560 for 2009).

For purposes of this calculation, "spousal share" is the amount equal to one-half of the total value of the countable resources of you and your spouse at the beginning of the most recent continuous period of institutionalization of the institutionalized spouse. The most recent continuous period of institutionalization is defined as the most recent period you or your spouse met the criteria listed in items 1 through 4 (under "If you or your spouse are:"). In determining the total value of the countable resources, we will not count the value of your home, household items, personal property, your car, or certain funds established for burial expenses.

The community spouse may be able to obtain additional amounts of resources to generate income when the otherwise available income of the community spouse, together with the income allowance from the institutionalized spouse, is less than the maximum community spouse monthly income allowance, by requesting a fair hearing or commencing a family court proceeding against the institutionalized spouse. Your attorney or local Office for the Aging can provide you with more information.

Either spouse or a representative acting on their behalf may request an assessment of the couple's countable resources, at the beginning, or any time after the beginning of a continuous period of institutionalization. Upon receipt of such request and all relevant documentation, the local district will assess and document the total value of the couple's countable resources and provide each spouse with a copy of the assessment and the documentation upon which it is based. If the request is not filed with a Medicaid application, the local department of social services may charge up to $25.00 for the cost of preparing and copying the assessment and documentation.

Information about income:

You may request an assessment/determination of:

(1) The community spouse monthly income allowance (an amount of up to $2,739 a month for 2009, if the community spouse has no income of his/her own); and

(2) A family allowance for each minor child, dependent child, dependent parent or dependent sibling of either spouse living with the community spouse (an amount of up to $608 as of February 1, 2009, if the family member has no income of his/her own).

The community spouse may be able to obtain additional amounts of the institutionalized spouse's income, due to exceptional circumstances resulting in significant financial distress, than would otherwise be allowed under the Medicaid program, by requesting a fair hearing or commencing a family court proceeding against the institutionalized spouse. Significant financial distress means exceptional expenses which the community spouse cannot be expected to meet from the monthly maintenance needs allowance or from amounts held in resources. These expenses may include, but are not limited to: recurring or extraordinary non-covered medical expenses (of the community spouse or dependent family members who live with the community spouse); amounts to preserve, maintain, or make major repairs to the home; and amounts necessary to preserve an income-producing asset. Social Services Law 366-c.2(g) and 366-c.4(b) require that the amount of such support orders be deducted from the institutionalized spouse's income for eligibility purposes. Such court orders are only effective back to the filing date of the petition. Please contact your attorney or local Office for the Aging for additional information.

If you wish to request an assessment of the total value of your and your spouse's countable resources, a determination of the community spouse resource allowance, community spouse monthly income allowance, or family member allowance(s) and the method of computing such allowances, please contact your local department of social services. New York City residents, calling from within New York City, should call the Human Resources Administration (HRA) Infoline toll-free at 1-877-472-8411. If calling from outside the five boroughs, the HRA Infoline number is (718) 557-1399.

Additional Information

For purposes of determining Medicaid eligibility for the institutionalized spouse, a community spouse must cooperate by providing necessary information about his/her resources. Refusal to provide the necessary information shall be reason for denying Medicaid for the institutionalized spouse because Medicaid eligibility cannot be determined. If denial of Medicaid would result in undue hardship for the institutionalized spouse and an assignment of support is executed or the institutionalized spouse is unable to execute such assignment due to physical or mental impairment, Medicaid shall be authorized. However, if the community spouse refuses to make such resource information available, then the Department, at its option, may refer the matter to court.

Undue hardship occurs when:

(1) A community spouse fails or refuses to cooperate in providing necessary information about his/her resources;

(2) The institutionalized spouse is otherwise eligible for Medicaid;

(3) The institutionalized spouse is unable to obtain appropriate medical care without the provision of Medicaid; and

(a) The community spouse's whereabouts are unknown; or

(b) The community spouse is incapable of providing the required information due to illness or mental incapacity; or

(c) The community spouse lived apart from the institutionalized spouse immediately prior to institutionalization; or

(d) Due to the action or inaction of the community spouse, other than the failure or refusal to cooperate in providing necessary information about his/her resources, the institutionalized spouse will be in need of protection from actual or threatened harm, neglect, or hazardous conditions if discharged from appropriate medical setting.

An institutionalized spouse will not be determined ineligible for Medicaid because the community spouse refuses to make his or her resources in excess of the community spouse resource allowance available to the institutionalized spouse if:

(1) The institutionalized spouse executes an assignment of support from the community spouse in favor of the social services district; or

(2) The institutionalized spouse is unable to execute such assignment due to physical or mental impairment.

Contribution from Community Spouse

The amount of money that we will request as a contribution from the community spouse will be based on his/her income and the number of certain individuals in the community depending on that income. We will request a contribution from a community spouse of 25% of the amount his/her otherwise available income that exceeds the minimum monthly maintenance needs allowance plus any family member allowance(s). If the community spouse feels that he/she cannot contribute the amount requested, he/she has the right to schedule a conference with the local department of social services to try to reach an agreement about the amount he/she is able to pay.

Pursuant to Section 366(3)(a) of the Social Services Law, Medicaid MUST be provided to the institutionalized spouse, if the community spouse fails or refuses to contribute his/her income towards the institutionalized spouse's cost of care. However, if the community spouse fails or refuses to make his/her income available as requested, then the Department, at its option, may refer the matter to court for a review of the spouse's actual ability to pay.

Request for Assessment Form

Date:_________________

Institutionalized Spouse's Name:

Address:

Telephone Number:

Community Spouse's Name:

Current Address:

Telephone Number:

I/we request an assessment of the items checked below:

[ ] Couple's countable resources and the community spouse resource allowance

[ ] Community spouse monthly income allowance

[ ] Family member allowance(s)

_______________________________________________

Signature of Requesting Individual

_______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

Address and telephone # if different from above

Check [ ] if you are a representative acting on behalf of either spouse. Please call your local department of social services if we do not contact you within 10 days of this request.

NOTE: If an assessment is requested without a Medicaid application, the local department of social services may charge up to $25 for the cost of preparing and copying the assessment and documentation.

Do you suspect that a Medicaid provider or an enrollee has engaged in fraudulent activities?

Return to Table of Contents

Call: 1-877-87FRAUD or (212 417-4570)

Your call will remain confidential.

You can also complete a Complaint Form online at:

www.omig.state.ny.us

Quick Reference Guide

Return to Table of Contents

Office of the Medicaid Inspector General:

http://www.omig.state.ny.us or call (518) 473-3782 with general inquiries or 1-800-87FRAUD with

suspected fraud complaints or allegations.

Questions about an Article?

Each article contains a contact number for further information, questions or comments.

Questions about billing and performing EMEVS transactions?

Please contact eMedNY Call Center at: (800) 343-9000.

Provider Training

To sign up for a provider seminar in your area, please enroll online at:

http://www.emedny.org/training/index.aspx

For individual training requests, call (800) 343-9000 or email: emednyproviderrelations@csc.com

Enrollee Eligibility

Call the Touchtone Telephone Verification System at any of the numbers below:

(800) 997-1111 (800) 225-3040 (800) 394-1234.

Address Change?

Questions should be directed to the eMedNY Call Center at: (800) 343-9000.

Fee-for-Service Providers

A change of address form is available at:

http://www.emedny.org/info/ProviderEnrollment/index.html

Rate-Based/Institutional Providers

A change of address form is available at:

http://www.emedny.org/info/ProviderEnrollment/index.html

Comments and Suggestions Regarding This Publication?

Please contact the editor, Kelli Kudlack, at:

medicaidupdate@health.state.ny.us

Medicaid Update is a monthly publication of the New York State Department of Health containing information regarding the care of those enrolled in the Medicaid Program.