New York State Medicaid Update - March 2024 Volume 40 - Number 3

In this issue …

- Policy and Billing Guidance

- Reminder: New York State Medicaid Expands Coverage of Predictive and Prognostic Tests for Breast Cancer Treatment

- Reminder: Coverage of Licensed Mental Health Counselor and Licensed Marriage and Family Therapist Services Provided in Article 28 Outpatient Hospital Clinics and Free-Standing Diagnostic and Treatment Centers

- Medicaid Fee-for-Service Comprehensive Guidance for New York State Federally Qualified Health Centers and Rural Health Clinics

- Pharmacy Providers: NYRx Pickup and Delivery Policy

- Doula Services for Pregnant and Postpartum People

- All Providers

- New York State Department of Health Telehealth Provider Survey Results Now Available

- Essential Plan Coverage for Pregnant Enrollees and Their Newborns

- Medicaid Breast Cancer Surgery Centers

- Practitioner Administered Drug Search Tool Now Available on the eMedNY Website

- 2024 Spousal Impoverishment Income and Resource Levels Increase

Information in gray boxes in this issue indicates material abridged but linked from the succinct interactive Portable Document Format (PDF) version.

Reminder: New York State Medicaid Expands Coverage of Predictive and Prognostic Tests for Breast Cancer Treatment

This article serves as a reminder following the New York State Medicaid Expansion of Prognostic Tests for Breast Cancer Treatment article published in the December 2023 issue of the Medicaid Update, effective December 1, 2023, New York State (NYS) Medicaid fee-for-service (FFS) and Medicaid Managed Care (MMC) expanded its coverage of predictive and prognostic breast cancer assays eligible for reimbursement to include Breast Cancer Index® and MammaPrint®, in addition to Oncotype DX®, EndoPredict® and Prosigna®.

This article further serves to clarify that Breast Cancer Index® is a predictive and prognostic genomic test that assists practitioners in making determinations regarding the appropriate duration of extended endocrine therapy (EET), supporting its routine clinical use in the management of patients beyond five years. EET beyond five years has been shown to reduce the risk of recurrence in some women with hormone receptor positive (HR+), early-stage breast cancer.

MammaPrint®, Oncotype DX®, EndoPredict® and Prosigna® are predictive and prognostic gene expression tests that assist practitioners in making determinations regarding the effective and appropriate use of chemotherapy in female or male patients with malignant neoplasms of the breast, when all the following criteria are met:

- The test results will aid the patient and practitioner in making the decision regarding chemotherapy (i.e., when chemotherapy is a therapeutic option and is not precluded due to any other factor).

- The tumor is estrogen receptor positive (ER+), progesterone receptor positive (PR+), or both.

- The tumor is human epidermal growth factor receptor 2 (HER2) negative.

- The tumor ("T") is T1 or T2.

- The tumor is node-negative or one to three positive nodes.

Please note: NYS Medicaid criteria for these tests are in accordance with current National Comprehensive Cancer Network (NCCN) Guidelines.

Additional information on NYS Medicaid coverage of prognostic breast cancer assays may be found in the New York State Medicaid Expansion of Prognostic Tests for Breast Cancer Treatment article published in the July 2019 issue of the Medicaid Update.

Questions and Additional Information:

- FFS coverage and policy questions should be directed to the Office of Health Insurance Programs (OHIP) Division of Program Development and Management (DPDM) by telephone at (518) 473-2160 or by email at FFSMedicaidPolicy@health.ny.gov.

- FFS billing/claim questions should be directed to the eMedNY Call Center at (800) 343-9000.

- MMC reimbursement, billing, and/or documentation requirement questions should be directed to the specific MMC Plan of the enrollee. MMC Plan contact information can be found in the eMedNY New York State Medicaid Program Information for All Providers - Managed Care Information document.

- Additional laboratory information and billing guidance is available in the eMedNY New York State Medicaid Program Fee-for-Service Laboratory Procedure Codes and Coverage Guidelines Manual.

Reminder: Coverage of Licensed Mental Health Counselor and Licensed Marriage and Family Therapist Services Provided in Article 28 Outpatient Hospital Clinics and Free-Standing Diagnostic and Treatment Centers

This article is intended to notify providers that State Plan Amendment (SPA) approval has been granted from the Centers for Medicare and Medicaid Services (CMS), allowing free-standing diagnostic and treatment centers (D&TCs) to bill New York State (NYS) Medicaid for services provided by Licensed Mental Health Counselors (LMHCs) and Licensed Marriage and Family Therapists (LMFTs), within their scope of practice, as defined by the NYS Education Department (NYSED).

As a reminder, per the Coverage of Licensed Mental Health Counselor and Licensed Marriage and Family Therapist Services Provided in Article 28 Outpatient Hospital Clinics and Free-Standing Diagnostic and Treatment Centers article published in the January 2023 issue of the Medicaid Update, Article 28 hospital outpatient departments (OPDs) and free-standing D&TCs, School-Based Health Centers (SBHCs) and Federally Qualified Health Centers (FQHCs), as well as Rural Health Clinics (RHCs), should use the rate codes listed below to request reimbursement from NYS Medicaid for mental health counseling when provided by LMHCs and LMFTs.

Article 28 Clinics

Hospital OPDs and free-standing D&TCs should use the following rate codes:

| Rate Codes | Rate Description | Reimbursement |

|---|---|---|

| 4222 | Individual LMHC/LMFT Services 20 to 30 minutes with patient | $44.10 |

| 4223 | Individual LMHC/LMFT Services 45 to 50 minutes with patient | $66.69 |

| 4224 | Family Services LMHC/LMFT with or without patient present | $44.10 |

SBHCs

SBHCs should use the following rate codes:

| Rate Codes | Rate Description | Reimbursement |

|---|---|---|

| 3260 | SBHC-Individual LMHC/LMFT Services 20 to 30 minutes with patient | $44.10 |

| 3261 | SBHC-Individual LMHC/LMFT Services 45 to 50 minutes with patient | $66.69 |

| 3262 | SBHC-Family services LMHC/LMFT with or without patient present | $75.30 |

FQHCs/RHCs

FQHCs and RHCs that have opted out of Ambulatory Payment Groups (APGs) should bill the Prospective Payment System (PPS) rate.

For additional information regarding mental health counseling services provided in Article 28 outpatient hospital clinics, as well as free-standing D&TCs, providers may refer to the Licensed Clinical Social Worker, Licensed Mental Health Counselor, and Licensed Marriage and Family Therapist Service Coverage article published in the December 2022 issue of the Medicaid Update.

Questions and Additional Information:

- Fee-for-service (FFS) claim questions should be directed to the eMedNY Call Center at (800) 343-9000.

- FFS coverage and policy questions should be directed to the Office of Health Insurance Programs (OHIP) Division of Program Development and Management (DPDM) by telephone at (518) 473-2160 or by email at FFSMedicaidPolicy@health.ny.gov.

- Medicaid Managed Care (MMC) reimbursement, billing, and/or documentation requirement questions should be directed to the MMC Plan of the enrollee.

- MMC Plan contact information can be found in the eMedNY New York State Medicaid Program Information for All Providers - Managed Care Information document.

Medicaid Fee-for-Service Comprehensive Guidance for New York State Federally Qualified Health Centers and Rural Health Clinics

The following article provides comprehensive policy and billing guidance pertaining to Article 28 clinics designated as Federally Qualified Health Centers (FQHCs) and Rural Health Clinics (RHCs).

Prospective Payment System

FQHCs and RHCs are reimbursed for New York State (NYS) Medicaid-covered services under an all-inclusive Prospective Payment System (PPS) rate as specified under §1902(bb) of the Social Security Act. The all-inclusive "threshold" rate includes all facility and professional fees associated with the services rendered to the NYS Medicaid member during the threshold visit. An eligible threshold visit is billable each time a NYS Medicaid member crosses the threshold of the FQHC/RHC and receives services from one of the qualified health care practitioners referenced below without regard to the number of services provided or time spent with the member during that visit. FQHCs/RHCs may only bill a single threshold visit per NYS Medicaid member per day.

FQHCs/RHCs should submit a single PPS claim for an eligible threshold visit utilizing the assigned rate code for each date of service the NYS Medicaid member is seen at the FQHC/RHC and include on the claim all of the specific Current Procedural Terminology (CPT)/Healthcare Common Procedure Coding System (HCPCS) codes for any/all service(s) rendered to the NYS Medicaid member on the date of service (DOS), including any evaluation and management/preventative medicine codes, significant procedures, and any associated ancillaries performed. Multiple medical and/or behavioral health encounters with more than one health care practitioner that take place on the same DOS constitute a single visit.

Eligible Threshold Visit

An eligible threshold visit is defined as a medically necessary, face-to-face (either in person or via telehealth), medical or behavioral health service rendered by one of the following qualified practitioners:

- Physicians;

- Physician Assistants (PAs);

- Nurse Practitioners (NPs);

- Licensed Midwives (LMs);

- Licensed Clinical Social Workers (LCSWs)/Licensed Master Social Workers (LMSWs)/Licensed Mental Health Counselors (LMHCs)/Licensed Marriage and Family Therapists (LMFTs);

- Licensed Behavior Analysts (LBAs)/Certified Behavior Analyst Assistants (CBAAs);

- Dentists/Dental Hygienists;

- Psychologists;

- Optometrist/Opticians;

- Physical Therapists (PTs)/Occupational Therapists (OTs)/Speech-Language Pathologists (SLPs);

- Podiatrists;

- Registered Dietitians; and

- Registered Nurses (RNs), Pharmacists, and Respiratory Therapists [PPS reimbursement is limited to only those providing diabetes self-management training (DSMT) and/or asthma self-management training (ASMT)].

Does Not Qualify as an Eligible Threshold Visit

Services provided by a practitioner other than a qualified practitioner listed above do not qualify as an eligible/billable threshold visit. Low-level services and supplies, including but not limited to, drawing blood, collecting urine specimens, performing laboratory tests, taking X-rays, filling and dispensing prescriptions, giving injections, immunizations, tobacco cessation counseling, and weight or blood pressure checks are not eligible/billable threshold visits. FQHCs/RHCs may not submit a threshold claim to NYS Medicaid for reimbursement when the only service rendered to the NYS Medicaid member was a low-level service.

Routine dental services are expected to be bundled to qualify as an eligible threshold visit, as outlined in the eMedNY New York State Medicaid Program Dental Policy and Procedure Code Manual. Screening of a patient ("D0190") application of fluoride varnish ("D1206") and topical application of fluoride ("D1208") do not qualify as a threshold visit when provided as a stand-alone service.

FQHCs/RHCs may bill an ordered ambulatory claim for certain specific services. FQHCs/RHCs should follow the guidance provided below for coverage policy and billing instructions for specific services:

- Long-Acting Reversible Contraception Carve-out for Federally Qualified Health Center Clinics article published in the September 2016 issue of the Medicaid Update;

- Medicaid Fee-for Service Coverage Policy and Billing Guidance for Vaccinations article published in the July 2020 issue of the Medicaid Update;

- New York State Medicaid Coverage Policy and Billing Guidance for the 2023-2024 COVID-19 Vaccines.

FQHC/RHC PPS Rate Codes

The following are NYS Medicaid fee-for-service (FFS) Article 28 FQHC/RHC rate codes. In situations where NYS Medicaid is not primary, FQHCs/RHCs will receive a payment equal to the difference between the NYS Medicaid PPS rate and the total of any/all payments (if any) already received from any/all primary payers.

| Rate Code | Description |

|---|---|

| 1609 | FQHC SHORTFALL/WRAP PAYMENT |

| 4011 | FQHC GROUP PSYCHOTHERAPY |

| 4012 | FQHC OFF-SITE SERVICES (INDIVIDUAL) |

| 4013* | FQHC INDIVIDUAL THRESHOLD VISIT |

| 4014 | FQHC GROUP PSYCHOTHERAPY (SBHC) |

| 4015 | FQHC OFF-SITE SERVICE (INDIVIDUAL) (SBHC) |

| 4016* | FQHC INDIVIDUAL THRESHOLD VISIT (SBHC) |

| 4026 | FQHC GROUP PSYCHOTHERAPY - COURT MANDATED |

| 4027 | FQHC OFF-SITE SERVICES (INDIV) - COURT-ORDERED |

| 4028 | FQHC INDIVIDUAL THRESHOLD VISIT - COURT-ORDERED |

Providers may not bill more than one of the above rate codes for the same NYS Medicaid member on the same DOS.

Alternate Rate Setting Methodology

FQHCs/RHCS may opt to participate in the Ambulatory Patient Group (APG) reimbursement methodology as an "alternative rate-setting methodology" instead of being reimbursed via the all-inclusive PPS rate. APGs are classified and reimbursed using software developed and published by 3M Health Information Systems (3M). FQHCs/RHCS that choose to be reimbursed via the APG reimbursement methodology cannot be negatively impacted in their NYS Medicaid reimbursement due to opting into the alternative rate-setting methodology. If a facility's NYS Medicaid reimbursement under APGs is lower than what their payment would have been under the all-inclusive PPS rate, the facility is entitled to receive a supplemental payment reflecting the difference between the amount paid to them under APGs and what they would have been paid using the all-inclusive PPS rate. Providers should refer to the NYS Department of Health (DOH) "Federally Qualified Health Center (FQHC)" web page, for additional information relative to the alternative rate-setting methodology.

FQHCs/RHCs that opt to receive payment via the APG reimbursement methodology should refer to the NYS DOH "Ambulatory Patient Groups (APGs)" web page, for additional information pertaining to rates, 3M Versions of the Definition Manual and Crosswalk, reimbursement components, regulations, policies, and APG weights.

Medicaid Managed Care

Under federal law, NYS is required to make supplemental payments to FQHCs/RHCs pursuant to a contract between the FQHCs/RHCs and a Managed Care Organization (MCO) and/or Independent Practice Association (IPA) for the amount, if any, the FQHCs/RHCs FFS NYS Medicaid rate exceeds the amount of payment provided under the Medicaid Managed Care (MMC) contract for the services rendered by the FQHC/RHC. These supplemental payments are made directly from NYS to FQHCs and RHCs via FFS claim submission, using rate code "1609".

Effective January 1, 2022, FQHCs and RHCs should no longer report any commercial insurance payments on their NYS Medicaid FFS supplemental claim submissions. This change will ensure that FQHCs and RHCs receive the complete supplemental payment. NYS Medicaid timely filing limits do apply and are enforceable for all supplemental claims submitted via rate code "1609".

Providers should refer to the NYS Managed Care Supplemental Payment Program for FQHCs Policy Document and the Update to Fee-for-Service Reimbursement for Federally Qualified Health Center Claims After Third-Party Payers and Managed Care Visit and Revenue Reporting Requirements article published in the January 2022 issue of the Medicaid Update, for additional information pertaining to the NYS Medicaid FFS supplemental rate calculation and payment policy.

Additionally, NYS Medicaid FFS is also required to make payments to FQHCs/RHCs for visits made by a MMC enrollee that are unpaid by the plan or not covered by a contract between the FQHC/RHC and MCO/IPA. In these situations, the State will reimburse FQHCs/RHCs the full FQHC/RHC rate. These claims should be billed using rate codes "4026", "4027", and "4028". NYS Medicaid timely filing limits do apply and are enforceable. Questions regarding MMC claim adjudication should be directed to the individual MMC Plan(s) the provider contracts with. Providers should refer to the MMC directory by plan, for additional information. Additionally, providers should work with the Office of Health Insurance Programs (OHIP) Division of Health Plan Contracting and Oversight (DHPCO) with issues associated with nonpayment from MCOs for eligible visits.

Questions and Additional Information:

- FFS coverage and policy questions should be directed to OHIP Division of Program Development and Management (DPDM) by telephone at (518) 473-2160 or by email at FFSMedicaidPolicy@health.ny.gov.

- MMC reimbursement, billing, and/or documentation requirement questions should be directed to the enrollee's MMC Plan. MMC Plan contact information can be found in the eMedNY New York State Medicaid Program Information for All Providers - Managed Care Information document.

- OHIP DHPCO is responsible for ensuring that the applicable laws and regulations relative to the MMC contracts are adhered to. Additional information and/or questions should be directed to bmcfhelp@health.ny.gov.

- FFS claim questions should be directed to the eMedNY Call Center at (800) 343-9000.

- FFS provider enrollment questions should be directed to eMedNY Provider Enrollment at (800) 343-9000.

Pharmacy Providers: NYRx Pickup and Delivery Policy

Prescription and over the counter (OTC) drugs dispensed pursuant to a prescription or fiscal order submitted to New York State (NYS) Medicaid for reimbursement for any portion, may be picked up at the pharmacy provider or may be delivered free of charge to the NYS Medicaid fee-for-service (FFS) member or Medicaid Managed Care (MMC) enrollee home or current residence including facilities and shelters. Additional information regarding signature, pick-up and delivery requirements can be found in the Pharmacy and Durable Medical Equipment, Prosthetics, Orthotics and Supplies Policy Manuals, located on the eMedNY "Provider Manuals" web page. This article supersedes the Clarification Regarding Pharmacy and Practitioner Dispensing of Drugs Requiring Administration by a Practitioner article published in the May 2023 issue of the Medicaid Update, and the Reminder: Pharmacy Delivery Policy article published in the July 2019 issue of the Medicaid Update.

Delivery Policy

All shipping and/or delivery costs shall be the responsibility of the provider of the service; however, the pharmacy is responsible for the delivery of product to the intended recipient. Prior to processing a drug claim, the pharmacy must confirm the drug is needed and that the drug had not been discontinued, changed or is no longer necessary (e.g., the NYS Medicaid member had changed pharmacy provider). The confirmation must be maintained in the patient record of the NYS Medicaid member. Automatic refills are not permitted. Prior to delivery, the pharmacy must obtain consent from the NYS Medicaid member or the individual authorized to consent on the behalf of the NYS Medicaid member to deliver. Consent shall be maintained in the patient record of the NYS Medicaid member and only the NYS Medicaid member or the individual authorized may receive the delivery.

If the provider uses a shipping service [e.g., FedEx, United States Postal Service (USPS), or courier] or any other delivery method, the proof of delivery documentation must include a complete record of tracking the item(s) from the pharmacy to the NYS Medicaid member. This would include the detailed description of prescriptions including prescription numbers, fiscal orders being delivered and the delivery tracking information from the delivery service, including date and time of delivery, outlined by the provider. Additionally, a handwritten or electronic signature of the recipient or authorized agent at time of delivery is required for all out-of-state (OOS), instate controlled substance or instate facility (site of administration) deliveries. Delivery industry tracking receipts (e.g., FedEx or USPS tracking receipts) qualify as a signature for receipt of delivery for instate non-controlled substance deliveries only.

A single signature (or "tracking receipt" as noted above) of the recipient or authorized agent verifying receipt will be sufficient for all the medications in the delivery. Electronic signatures of the recipient or authorized agent for receipt or electronic tracking slips for delivery are permitted only if retrievable on audit. The pharmacy is responsible for drug integrity and must deliver intact, usable drugs, under the appropriate storage conditions. The pharmacy is responsible to replace lost, stolen or mis-directed drugs at no additional cost to the NYS Medicaid member or NYS Medicaid Program. Pharmacy providers who deliver medication without NYS Medicaid member or authorized individual consent will be required to accept the return of the medication, credit NYS Medicaid the claim and destroy those drugs per State Law. All NYS Medicaid claims for drugs not picked up or delivered must be reversed within 14 days. All State counseling laws apply. Additional information can be found on the New York State Education Department (NYSED) "Questions and Answers for Pharmacists and Pharmacies July 10, 2003" web page.

Questions and Additional Information:

- NYRx claim questions should be directed to the eMedNY Call Center at (800) 343-9000.

- NYRx coverage and policy questions should be directed to the NYS Medicaid Pharmacy Policy Unit by telephone at (518) 486-3209 or by email at NYRx@health.ny.gov.

Doula Services for Pregnant and Postpartum People

Effective March 1, 2024, New York State (NYS) Medicaid will reimburse for doula services for all pregnant and postpartum NYS Medicaid members needing the service. Between March 1, 2024, through September 30, 2024, doula services will be carved out of the Medicaid Managed Care (MMC) benefit package. NYS Medicaid-enrolled doula providers may bill Medicaid fee-for-service (FFS) for covered doula services, including doula services provided to MMC enrollees during this period. Effective October 1, 2024, doula services will be covered by MMC Plans [inclusive of mainstream MMC Plans, Human Immunodeficiency Virus-Special Needs Plans (HIV-SNPs), as well as Health and Recovery Plans (HARPs)]. Doula services provided to MMC enrollees between March 1, 2024 and September 30, 2024 will be billed to Medicaid FFS. Doula services provided on or after October 1, 2024, will be billed to the MMC Plan of the enrollee.

NYS Medicaid members, including NYS Medicaid members enrolled in MMC, are eligible for doula services during pregnancy and up to 12 months after the end of a pregnancy, regardless of the pregnancy outcome. If a NYS Medicaid member becomes pregnant within the 12 months following a prior pregnancy, their eligibility for doula services will start over with the new pregnancy; any unused perinatal doula services from the prior pregnancy will not carry over.

NYS Medicaid members, including NYS Medicaid members enrolled in MMC, will be eligible for coverage of doula services under the statewide Medicaid doula services benefit regardless of the amount of doula services they may have received through Medicaid's Erie County Doula Service Pilot program. This article supersedes all previously published articles pertaining to doula services. The Erie County Doula Service Pilot program ended as of February 29, 2024, and this statewide doula services benefit and the associated policy and billing guidance take the place of the coverage, policy, and billing guidance provided under the pilot program.

Doula services are a preventative health service, and as such, must be recommended by a physician or other licensed practitioner of the healing arts acting within their scope of practice under State law to be eligible for NYS Medicaid reimbursement. Licensed providers of perinatal and maternity care services are to discuss the benefits of doula care with NYS Medicaid members, and as long as it is clinically appropriate, to provide all such enrollees with a recommendation for doula services.

A doula is a public health worker, not otherwise recognized as a licensed or certified NYS Medicaid provider type, that provides direct support, education and advocacy to the pregnant, postpartum and post-pregnant populations. The doula will directly enroll as a NYS Medicaid doula services provider and will bill NYS Medicaid directly for doula services. The NYS Medicaid-enrolled doula does not require supervision. Doula services will include up to eight perinatal visits by a doula during and after pregnancy and one labor and delivery support encounter. Additionally, doula services may include:

- intermittent support that aligns with personal and cultural preferences during the prenatal, childbirth, postpartum and newborn periods, inclusive of all pregnancy outcomes;

- education, guidance, health navigation, and connections to community-based resources related to childbirth and parenting;

- development of a birth plan and continuous labor support;

- patient-centered advocacy, and physical, emotional, and nonmedical support;

- facilitation of communication between the NYS Medicaid member and medical providers; and

- discussion of the importance of perinatal and pediatric health services provided by a licensed health provider during pregnancy and labor and delivery, and after pregnancy and the birth of the infant.

Billing Medicaid FFS During MMC Carve Out

Doula services will be carved out of the MMC Plan benefit packages from March 1, 2024, through September 30, 2024. NYS Medicaid members who are enrolled in Medicaid FFS or MMC Plans are eligible for NYS Medicaid coverage of doula services during and after the MMC carve out.

During the carve out period (March 1, 2024 through September 30, 2024), all covered doula services are to be billed to Medicaid FFS, even for NYS Medicaid members who are enrolled in an MMC Plan. Doula services will only be reimbursed when provided by doulas that have enrolled as NYS Medicaid providers. Effective October 1, 2024, covered doula services will be added to the MMC benefit package and reimbursable by MMC Plans.

Medicaid FFS Billing Information:

- Doula services are provided on an individual basis with the NYS Medicaid member.

- To qualify for NYS Medicaid reimbursement for perinatal doula services, the service:

- must involve a direct interaction with the NYS Medicaid member;

- must meet the minimum time frame for the doula service; and

- can be administered in-person or via telehealth, in accordance with NYS Medicaid telehealth policy (providers should refer to the NYS Department of Health "NYS Medicaid Telehealth" web page.

- To qualify for NYS Medicaid reimbursement for labor and delivery doula services, the service:

- must involve a direct interaction with the NYS Medicaid member;

- must be provided to the NYS Medicaid member in-person except in extenuating circumstances, such as illness, emergency or precipitous birth, in which case the current telehealth policy will apply; and

- a licensed perinatal services provider must be in attendance in order for the doula to be reimbursed for the labor and delivery encounter.

- Reimbursement is not available for service visits/appointments that are not kept;

- Multiple visits are not allowed in the same day except for the following instances:

- A perinatal doula visit occurs early in the day, and a labor and delivery doula visit occurs later in the day, or

- A labor and delivery doula encounter occurs early in the day, and a perinatal doula visit occurs later in the day.

- NYS Medicaid providers are not allowed to balance bill NYS Medicaid members, including NYS Medicaid members enrolled in MMC; payment received from NYS Medicaid is considered payment in full for services rendered.

Doula Services Healthcare Common Procedure Coding System (HCPCS) Procedure Codes

| HCPCS Code | Diagnosis Code(s) | Code Description | Service Description | Per Pregnancy Allowance | Reimbursement Rate |

|---|---|---|---|---|---|

| T1032 | Z32.2 (prenatal/ pregnancy) Z32.3 (postpartum) |

Services provided by a doula birth worker. | Perinatal Service: Prenatal or postpartum doula support (minimum of 30 minutes). |

Up to and including eight times | NYC: $93.75 per visit Rest of State: $84.37 per visit |

| T1033 | Z32.2 | Services provided by a doula birth worker, per diem. | Labor and Delivery: In-person doula support during labor and birth (no time minimum, must be present for the birth). |

Up to and including one time | NYC: $750.00 Rest of State: $675.00 |

MMC Billing Instructions

During the MMC Carve Out Period (March 1, 2024 through September 30, 2024)

NYS Medicaid-enrolled doulas who elect to contract with MMC Plans may negotiate or renegotiate MMC contracts in preparation for reimbursement of eligible doula services. For dates of service (DOS) on or after October 1, 2024, doulas who have a contract with an MMC Plan will be reimbursed by the MMC Plan for all eligible doula services.

After MMC Carve Out Period (October 1, 2024, and after):

If an MMC enrollee is receiving services prior to October 1, 2024, MMC Plans are required to cover the doula services and continue the Medicaid FFS equivalent until 12 months after the end of the pregnancy, regardless of pregnancy outcome.

- The doula is required to begin billing the MMC plan of the enrollee for DOS on or after October 1, 2024.

- The MMC Plan is required to ensure continuity of care for these services for enrollees, even if the doula is not contracted with the MMC Plan as of October 1, 2024. Please note: This only applies if the MMC enrollee was receiving services from the billing doula prior to October 1, 2024.

- The MMC Plan will reimburse no less than the FFS equivalent until 12 months after the end of the pregnancy, regardless of pregnancy outcome.

If an MMC enrollee has not received services prior to October 1, 2024, doula services will be reimbursed by the MMC Plan only if:

- the doula is enrolled as a Medicaid FFS provider,

- the doula has contracted with the individual MMC Plan in which the NYS Medicaid member is enrolled, and

- the doula is billing the MMC Plan.

For NYS Medicaid members enrolled in MMC, providers must contact the MMC Plan of the enrollee for billing instructions that apply on and after October 1, 2024. MMC Plan contact information can be found in the eMedNY New York State Medicaid Program Information for All Providers - Managed Care Information document.

Questions and Additional Information:

- Additional information can be found in the New York State Medicaid Program Doula Manual Policy Guidelines, located on the eMedNY "Doula" web page.

- Medicaid FFS claim questions should be directed to the eMedNY Call Center at (800) 343-9000.

- FFS coverage and policy questions should be sent to MaternalandChild.HealthPolicy@health.ny.gov.

- MMC questions should be directed to the MMC Plan of the enrollee. MMC Plan contact information can be found in the eMedNY New York State Medicaid Program Information for All Providers - Managed Care Information document.

New York State Department of Health Telehealth Provider Survey Results Now Available

The Telehealth Provider Survey results are now available on the New York State (NYS) Department of Health (DOH) Medicaid Telehealth website, via infographic.

Background

In order to better understand NYS health care provider perspectives on telehealth during and after the Coronavirus Disease 2019 (COVID-19) public health emergency (PHE), NYS DOH conducted the Telehealth Provider Survey, which was active from August 2023 to October 2023. All NYS health care providers, whether they have used telehealth services or not, were encouraged to complete the survey. Survey results are being used to inform future telehealth policy development in NYS.

Questions

All questions regarding the Telehealth Provider Survey resultsinfographic should be sent to the NYS DOH at Telehealth.Policy@health.ny.gov.

Essential Plan Coverage for Pregnant Enrollees and Their Newborns

In an effort to continue to address the affordability of health insurance for New Yorkers, New York State (NYS) received approval to expand the Essential Plan (EP) to New Yorkers with incomes up to 250 percent of the Federal Poverty Level (FPL), effective April 1, 2024. In addition, under the Section 1332 State Innovation Waiver, pregnant individuals who were enrolled in EP prior to reporting their pregnancy will stay enrolled in EP after reporting their pregnancy. Pregnant individuals are still required to update their NY State of Health (Marketplace) account with their pregnancy information, regardless of which program they are enrolled in at the point they become pregnant. After reporting their pregnancy, EP-enrolled individuals will no longer be moved to NYS Medicaid as they would have been before the waiver was approved. EP enrollees who remain enrolled in EP after reporting their pregnancy will not receive an Unborn Client Identification Number (CIN) or Common Benefit Identification Card (CBIC) for their unborn as they would have if they were enrolled in NYS Medicaid.

At this time, individuals enrolled in EP need to apply for coverage for their newborns as soon as possible, but no later than three months after birth. Babies born to individuals who remained enrolled in EP during their pregnancy will not be considered a deemed newborn,as defined in Social Services Law (SOS) §366-g; however, they will have a NYS Medicaid determination performed once they are added to the NY State of Health account of their family. Once a newborn has been determined eligible for NYS Medicaid, they will receive a notice indicating the start date of their coverage and a CBIC. If the newborn is eligible to enroll in a Medicaid Managed Care (MMC) Plan, a plan would need to be selected for them as they will not automatically be enrolled into the NYS Medicaid version of their birthing parent's EP. If the birthing individual applies for coverage for the newborn after the month of birth, a retroactive eligibility determination should be requested. The retroactive period will assist in effectuating coverage back to the month of birth of the newborn.

Allowing the pregnant individual to stay enrolled in EP rather than transitioning to NYS Medicaid will help to maintain consistent coverage for pregnant individuals during their pregnancy. However, if the pregnant individual wishes to enroll in NYS Medicaid, they will need to contact NY State of Health Customer Service at (855) 355-5777.

Questions and Additional Information:

- FFS claim questions should be directed to the eMedNY Call Center at (800) 343-9000.

- Newborn eligibility and policy questions can be emailed to MedicaidNewbornQuestions@health.ny.gov.

Medicaid Breast Cancer Surgery Centers

Research shows that five-year survival rates are higher for patients who have their breast cancer surgery performed at high-volume facilities. Therefore, it is the policy of the New York State (NYS) Department of Health (DOH) that NYS Medicaid members receive mastectomy and lumpectomy procedures associated with a breast cancer diagnosis at high-volume hospitals and ambulatory surgery centers defined as averaging 30 or more all-payer surgeries annually over a three-year period. Restricted low-volume facilities will not be reimbursed for breast cancer surgeries provided to NYS Medicaid members.

Each year, NYS DOH reviews the list of low-volume facilities and releases an updated list, effective April 1, 2024. NYS DOH has completed its annual review of all-payer breast cancer surgical volumes for 2020 through 2022 using the Statewide Planning and Research Cooperative System (SPARCS) database. Two hundred and fifteen restricted low-volume hospitals and ambulatory surgery centers throughout NYS were identified. These facilities have been notified of the restriction, effective April 1, 2024. The policy does not restrict the ability of the facility to provide diagnostic or excisional biopsies and post-surgical care (chemotherapy, radiation, reconstruction, etc.) for NYS Medicaid members.For mastectomy and lumpectomy procedures related to breast cancer, NYS Medicaid members should be directed to high-volume providers in their area.

To view the list of hospitals and ambulatory surgery centers where Medicaid will not pay for breast cancer surgery, providers should refer to the NYS DOH "Hospitals & Ambulatory Surgery Centers Where Medicaid Will Not Pay for Breast Cancer Surgery" web page. To view the list of hospitals and ambulatory surgery centers where Medicaid will pay for breast cancer surgery, providers should refer to the NYS DOH "Hospitals & Ambulatory Surgery Centers Where Medicaid Will Pay for Breast Cancer Surgery" web page.

Questions

Questions should be directed to hcre@health.ny.gov.

Practitioner Administered Drug Search Tool Now Available on the eMedNY Website

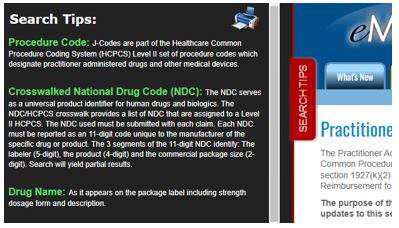

The 2005 Federal Deficit Reduction Act (DRA) requires providers to report the National Drug Code (NDC) when billing for practitioner administered drugs (PADs) to New York State (NYS) Medicaid and existing reporting requirements. A new resource, Practitioner Administered Drug (PAD) Search Tool, is now available on the eMedNY "Practitioner Administered Drug (PAD) Search Tool" web page, which allows providers to search for covered drugs administered by a health care practitioner in physician offices or other outpatient clinical settings. The PAD Search Tool, shown below, provides helpful billing information regarding physician-administered drugs that are billed to the medical benefit using an appropriate Healthcare Common Procedure Coding System (HCPCS) code and NDC.

Users may search the PAD Search Tool using the following criteria:

- Drug name using a minimum of four characters (partial searches of the drug name are accepted and produce matching results);

- HCPCS code using the complete five-digit code;

- NDC using a minimum of four-digits; and

- Category of Service (COS) using the complete four-digit number.

The PAD Search Tool aims to assist providers in utilizing the correct HCPCS and NDC billing units, as required by 2005 Federal DRA. Providers should utilize the "Search Tips" toolbar on the left side of the eMedNY "Practitioner Administered Drug (PAD) Search Tool" web page, for definitions and further descriptions.

Results can be expanded to view further information about the drug and HCPCS code. Information related to both the NDC unit type and HCPCS billing unit are displayed in the "Billing Unit Type" and "HCPCS Code Dosage Description" fields, respectively. To review drugs covered under the pharmacy benefit, providers should continue to utilize the New York State Department of Health List of Medicaid Reimbursable Drugs located on the eMedNY "Medicaid Pharmacy List of Reimbursable Drugs" web page.

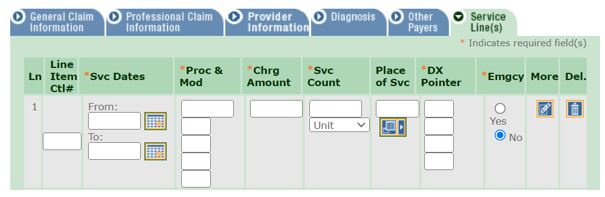

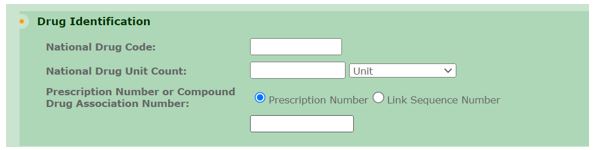

Clarification Regarding Billing Units

When completing sections pertaining to NDC, providers should utilize the "Billing Unit Type" displayed on the PAD Search Tool as the basis for quantity. This is typically a volumetric unit (gram or milliliter) administered to the patient. In the "Search Result Example" provided below, the drug is available in a package size of 10 mg with a concentration of 40 mg/1 ml. If the dose administered is 40 mg, the value entered in the NDC quantity field would be 1 ml. Providers must ensure this section is completed for unlisted codes "J3490" and "J3590".

When completing sections pertaining to the HCPCS code, providers should utilize the "HCPCS Code Dosage Description" field as the basis for units billed. In the "Search Result Example" provided below, HCPCS unit is represented as 10 mg per unit. Therefore, a 40 mg dose would be billed as 4 units of 10 ml. This value is unique to each HCPCS code.

Search Result Example

Electronic Claim Example

NYS Department of Health (DOH) encourages providers to use the PAD Search Tool to assist in completing an Electronic Provider Assisted Claim Entry System (ePACES) electronic claim. See below for an example to better understand which fields map to the PAD Search Tool:

New Claim - 837 Professional

Additional information regarding ePACES can be found in the ePACES Professional Real Time Claim Reference Guide.

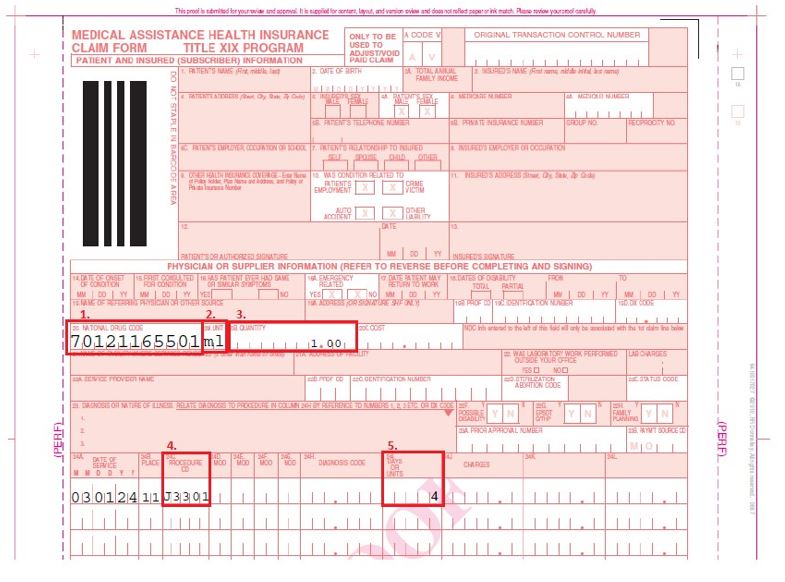

150003 Paper Claim Example

NYS DOH encourages providers to use the PAD Search Tool to assist in completing the 150003 paper claim. Providers should refer to the example provided below to better understand which fields map to the PAD Search Tool:

The PAD Search Tool may be consulted to ensure the information entered into the 150003 paper form.

- Field 20: National Drug Code

Verify the NDC utilized is found in the crosswalk for the procedure code submitted in field 24C. - Field 20A: Unit

The NDC unit of measure. Provides the description of the corresponding valid units of measure per the NCPDP standard. The value entered in this field corresponds to the "Billing Unit Type" found on the PAD Search Tool. This unit should be utilized when billing for unlisted codes "J3490" and "J3590". - Field 20B: Quantity

The number of units from 20A administered to the patient. An injection of 1 ml would be reported as "ML" entered into 20A and "1.00" entered in 20B. - Field 24C: Procedure Code

The primary five-digit HCPCS code. - Field 24I: Days or Units

The value entered in this field should correspond to the "HCPCS Code Dosage Description" (found on the PAG Search Tool) of the procedure code used in 24C (e.g., an injection of 40 mg with a "HCPCS Code Dosage Description" of "10 MG" would be entered as "4". This represents four units of 10 mg).

Questions and Additional Information:

- Further information regarding the 150003 paper claim form can be found in the eMedNY New York State 150003 Billing Guidelines.

- NYRx claim questions should be directed to the eMedNY Call Center at (800) 343-9000.

- NYRx Pharmacy coverage and policy questions should be directed to the NYS Medicaid Pharmacy Policy Unit by telephone at (518) 486-3209 or by email at NYRx@health.ny.gov.

2024 Spousal Impoverishment Income and Resource Levels Increase

Providers of nursing facility services, certain home and community-based waiver services, and services to individuals enrolled in a Managed Long Term Care Plan are required to print and distribute the "Information Notice to Couples with an Institutionalized Spouse" (see "Appendix" on page 18 of this issue) at the time they begin to provide services to their patients.

Effective January 1, 2024, the federal maximum Community Spouse Resource Allowance increased to $154,140.00, while the community spouse monthly income allowance increased to $3,853.50. The maximum family member monthly allowance increased to $852.00. This information should be provided to any institutionalized spouse, community spouse, or representative acting on their behalf to avoid unnecessary depletion of the amount of assets a couple can retain under the Medicaid program spousal impoverishment eligibility provisions.

| Date | Allowance |

|---|---|

| January 1, 2024 | Federal Maximum Community Spouse Resource Allowance: $154,140.00 Please note: A higher amount may be established by court order or fair hearing to generate income to raise the community spouse's monthly income up to the maximum allowance. Please note: The State Minimum Community Spouse Resource Allowance is $74,820.00. |

| January 1, 2024 | Community Spouse Minimum Monthly Maintenance Needs Allowance: An amount up to $3,853.50 (if the community spouse has no income of their own) Please note: A higher amount may be established by court order or fair hearing due to exceptional circumstances that result in significant financial distress |

| January 1, 2024 | Family Member Monthly Allowance (for each family member): An amount up to $852.00 (if the family member has no income of their own). |

Please note: If the institutionalized spouse is receiving Medicaid, any change in income of the institutionalized spouse, the community spouse, and/or the family member may affect the community spouse income allowance and/or the family member allowance. Therefore, the social services district should be promptly notified of any income variations.

Information Notice to Couples with an Institutionalized Spouse

- "Information Notice to Couples with an Institutionalized Spouse"e; is available as a PDF.

- Additionally, the Request for Assessment - Spousal Impoverishment form should be printed and distributed.

Medicaid is an assistance program that may help pay for the costs of your or your spouse's institutional care, home and community-based waiver services, or enrollment in a Managed Long Term Care Plan. The institutionalized spouse is considered medically needy if their resources are at or below a certain level and the monthly income after certain deductions is less than the cost of care in the facility. Federal and State laws require that spousal impoverishment rules be used to determine an institutionalized spouse's eligibility for Medicaid. These rules protect some of the income and resources of the couple for the community spouse. Please note: Spousal impoverishment rules do not apply to an institutionalized spouse who is eligible under the Modified Adjusted Gross Income rules.

If you or your spouse are:

- In a medical institution or nursing facility and are likely to remain there for at least 30 consecutive days; or

- Receiving home and community-based services provided pursuant to a waiver under §1915(c) of the federal Social Security Act and are likely to receive such services for at least 30 consecutive days; or

- Receiving institutional or non-institutional services and are enrolled in a Managed Long Term Care Plan; and

- Married to a spouse who does not meet any of the criteria set forth under items 1 through 3 listed above, these income and resource eligibility rules for an institutionalized spouse may apply to you or your spouse.

If you wish to discuss these eligibility provisions, please contact your local department of social services to request an assessment of the total value of your or your spouses combined countable resources, even if you have no intention of pursuing a Medicaid application. It is to the advantage of the community spouse to request such an assessment to make certain that allowable resources are not depleted by you for your spouse's cost of care. To request such an assessment, please contact your local department of social services or complete and mail the Request for Assessment - Spousal Impoverishment form (DOH-5298). New York City residents may contact the Human Resources Administration Medicaid Helpline at (888) 692-6116.

| Resource Information |

|---|

Effective January 1, 1996, the community spouse is allowed to keep resources in an amount equal to the greater of the following amounts:

|

For purposes of this calculation, "spousal share" is the amount equal to one-half of the total value of the countable resources of you and your spouse at the beginning of the most recent continuous period of institutionalization of the institutionalized spouse. The most recent continuous period of institutionalization is defined as the most recent period you and your spouse met the criteria listed in items 1 through 4 (listed under the "If you or your spouse are" section above). In determining the total value of the countable resources, we will not count the value of your home, household items, personal property, car, or certain funds established for burial expenses.

The community spouse may be able to obtain additional amounts of resources to generate income when the otherwise available income of the community spouse, together with the income allowance from the institutionalized spouse, is less than the maximum community spouse monthly income allowance, by requesting a fair hearing or commencing a family court proceeding against the institutionalized spouse. You can contact your local department of social services or an attorney about requesting a Medicaid fair hearing. Your attorney can provide more information about commencing a family court proceeding. You may be able to get a lawyer at no cost by calling your local Legal Aid or Legal Services Office. For names of other lawyers, call your local or State Bar Association.

Either spouse, or a representative acting on their behalf, may request an assessment of the couple's countable resources at the beginning or any time after the beginning of a continuous period of institutionalization. Upon receipt of such request and all relevant documentation, the local district will assess and document the total value of the couple's countable resources and provide each spouse with a copy of the assessment and the documentation upon which it is based. If the request is not filed with a New York State Medicaid application, the local department of social services may charge up to $25.00 for the cost of preparing and copying the assessment and documentation.

| Income Information |

|---|

A spouse may request an assessment/determination of:

|

The community spouse may be able to obtain additional amounts of the institutionalized spouse's income, due to exceptional circumstances resulting in significant financial distress, then would otherwise be allowed under the Medicaid program, by requesting a fair hearing or commencing a family court proceeding against the institutionalized spouse. Significant financial distress means exceptional expenses which the community spouse cannot be expected to meet from the monthly maintenance needs allowance or from amounts held in resources. These expenses may include but are not limited to recurring or extraordinary non-covered medical expenses (of the community spouse or dependent family members who live with the community spouse); amounts to preserve, maintain, or make major repairs to the home; and amounts necessary to preserve an income-producing asset. Social Services Law §366-c(2)(g) and §366-c(4)(b), require that the amount of such support orders be deducted from the institutionalized spouse's income for eligibility purposes. Such court orders are only effective back to the filing date of the petition. Please contact your attorney for additional information about commencing a family court proceeding.

If you wish to request an assessment of the total value of your or your spouse's countable resources, a determination of the community spouse resource allowance, community spouse monthly income allowance, or family member allowance(s) and the method of computing such allowances, please contact your local department of social services. New York City residents should call the Human Resources Administration Medicaid Helpline at (888) 692-6116.

Spousal Refusal and Undue Hardship Concerning a Community Spouse's Refusal to Provide Necessary Information

For purposes of determining Medicaid eligibility for the institutionalized spouse, a community spouse must cooperate by providing necessary information about their resources. Refusal to provide the necessary information shall be reason for denying Medicaid for the institutionalized spouse as Medicaid eligibility cannot be determined. If the applicant or recipient demonstrates that denial of Medicaid would result in undue hardship for the institutionalized spouse and an assignment of support is executed or the institutionalized spouse is unable to execute such assignment due to physical or mental impairment, Medicaid shall be authorized. However, if the community spouse refuses to make such resource information available, the New York State Department of Health or local department of social services, at its option, may refer the matter to court for recovery from the community spouse of any Medicaid expenditures for the institutionalized spouse's care.

Undue hardship occurs when:

- A community spouse fails or refuses to cooperate in providing necessary information about their resources;

- The institutionalized spouse is otherwise eligible for Medicaid;

- The institutionalized spouse is unable to obtain appropriate medical care without the provision of Medicaid; and

- The community spouse's whereabouts are unknown; or

- The community spouse is incapable of providing the required information due to illness or mental incapacity; or

- The community spouse lived apart from the institutionalized spouse immediately prior to institutionalization; or

- Due to the action or inaction of the community spouse, other than the failure or refusal to cooperate in providing necessary information about their resources, the institutionalized spouse will need protection from actual or threatened harm, neglect, or hazardous conditions if discharged from an appropriate medical setting.

An institutionalized spouse will not be determined ineligible for Medicaid because the community spouse refuses to make their resources in excess of the community spouse resource allowance available to the institutionalized spouse if:

- The institutionalized spouse executes an assignment of support from the community spouse in favor of the social services district; or

- The institutionalized spouse is unable to execute such assignment due to physical or mental impairment.

Income Contribution from the Community Spouse

The amount of money that Medicaid will request as a contribution from the community spouse will be based on their income and the number of certain individuals in the community household depending on that income. Medicaid will request a contribution from a community spouse of 25 percent of the amount their otherwise available income that exceeds the minimum monthly maintenance needs allowance plus any family member allowance(s). If the community spouse feels that they cannot contribute the amount requested, the community spouse has the right to schedule a conference with the local department of social services to try to reach an agreement about the amount the community spouse is able to pay. Pursuant to Social Services Law §366(3)(a), Medicaid must be provided to the institutionalized spouse if the community spouse fails or refuses to contribute their income towards the institutionalized spouse's cost of care. However, if the community spouse fails or refuses to make their income available as requested, then the New York State Department of Health or the local department of social services, at its option, may refer the matter to court for a review of the community spouse's actual ability to pay.

The Medicaid Update is a monthly publication of the New York State Department of Health.

Kathy Hochul

Governor

State of New York

James McDonald, M.D., M.P.H.

Acting Commissioner

New York State Department of Health

Amir Bassiri

Medicaid Director

Office of Health Insurance Programs